Net Realizable Value Formula

Net Realizable Value Formula

An accounts receivable balance is converted into cash when customers pay their outstanding invoices, but the balance must be adjusted down for clients who don’t make payment. NRV for accounts receivable is calculated as the full receivable balance less an allowance for doubtful accounts, which is the dollar amount of invoices that the company estimates to be bad debt. Walmart is a US-based retail supermarket chain-based company with around $500Bn of revenue as per the financial year 2018.

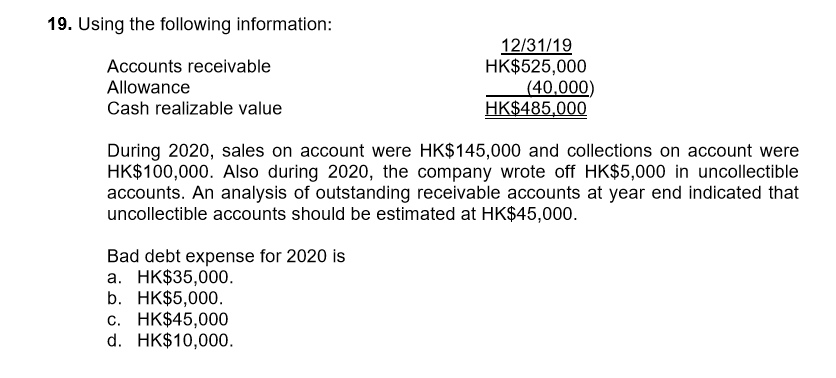

How do you calculate cash realizable value?

The cash realizable value is the amount of money you expect to receive from your accounts receivable after deducting the uncollectable amount. Subtracting the uncollectable amount from your accounts receivable gives you the cash realizable value of your accounts receivable.

Examples of Net Realizable Value

This concept is known as the lower of cost and netrealizable value, or LCNRV. GAAP rules previously required accountants to use the lower of cost or market (LCM) method to value inventory on the balance sheet. If the market price of inventory fell to below the historical cost, the principle of conservatism required accountants to use the market price to value inventory. Market price was defined as the lower of either replacement cost or NRV.IBM is a US-based Software company with more than $80 Bn of revenue per year. Let’s say in the Financial year 2019, the market value of Accounts Receivable (which is an asset) for IBM is $10 Bn.

BUSINESS OPERATIONS

Therefore, the net realizable value of the inventory is $12,000 (selling price of $14,000 minus $2,000 of costs to dispose of the goods). In that situation the inventory must be reported at the lower of 1) the cost of $15,000, or 2) the NRV of $12,000. In this situation, the inventory should be reported on the balance sheet at $12,000, and the income statement should report a loss of $3,000 due to the write-down of inventory. The lower of cost or market method lets companies record losses by writing down the value of the affected inventory items.

What is meant by net Realisable value?

The cash realizable value, or net realizable value, of a company’s accounts receivable is the amount the company expects to receive in cash as payment from customers. The net realizable value equals the dollar amount of accounts receivable minus the dollar amount of allowance for uncollectible accounts.Which means IBM is expected to receive this amount from customers which have already been recognized as revenue in its accounts. But for calculating the Net Realizable Value, IBM will have to identify the customers who can default on their payments.

How do I Calculate Uncollectible Accounts?

The amount by which the inventory item was written down is recorded under cost of goods sold on the balance sheet. NRV is a common method used to evaluate an asset’s value for inventory accounting. NRV is a valuation method used in both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).This approach is similar to those accounting requirements that apply to certain classes of investments owned by companies such as marketable securities held for trading purposes. NRV is the total amount which a company can expect while selling its assets.

net realizable value of accounts receivable

- Net realizable value (NRV) is the value of an asset which can be realized when that asset is sold.

- All the related cost like disposal cost, transportation cost etc. should be subtracted while calculating a net realizable value.

- It is also termed as cash Realizable value since it is the cash amount which one gets for the asset.

Net realizable value is an important metric that is used in the lower cost or market method of accounting reporting. Under the market method reporting approach, the company’s inventory must be reported on the balance sheet at a lower value than either the historical cost or the market value. If the market value of the inventory is unknown, the net realizable value can be used as an approximation of the market value. The lower of cost or market rule traditionally applies to companies whose products become obsolete.Net realizable value (NRV) is the value of an asset which can be realized when that asset is sold. It is also termed as cash Realizable value since it is the cash amount which one gets for the asset. All the related cost like disposal cost, transportation cost etc. should be subtracted while calculating a net realizable value. So during inventory valuation, NRV is the price cap for the asset if we use a market method of accounting. In that method, inventory is valued at either historical cost or market value, whichever is lower.Let’s say in the Financial year 2018, a market value of Inventory (which is also an asset) for Walmart is around $44 Bn. Let’s say out of it, Walmart is going to sell some part of the inventory to another company for $4 Bn for offloading purposes. Walmart needs to decide the NRV of this part of Inventory. For that Walmart needs to calculate the cost associated with the Sale of Inventory. Let’s say transportation cost is $500 Mn and legal and registration charges are $100 Mn.

Recently, the FASB issued an update to their code and standards that affect companies that use the average cost and FIFO methods of inventory accounting. Companies that use these two methods of inventory accounting must now use the lower of cost or net realizable value method, which is more consistent with IFRS rules. The lower of cost or market (LCM) method states that when valuing a company’s inventory, it is recorded on the balance sheet at either the historical cost or the market value. Historical cost refers to the cost at which the inventory was purchased. The lower of cost or market method is a way to record the value of inventory which places an emphasis on not overstating the value of the assets.In addition, when assets and liabilities are recorded on the balance sheet at their fair market values, any change in value typically flows to the income statement. Once again, critics of the approach believe this will lead to distortions in the perceived profitability of a company. The objective of the current cost accounting method is to report the financial assets and liabilities of a company at their fair market value rather than historical cost. For example, the book value of the vehicles owned by a company may be $15,000,000; however, the fair market value of the vehicles might be closer to $8,000,000.

Calculating the Cash Realizable Value

If we are not able to determine the market value, NRV can be used as a proxy for that. Net realizable value (NRV) is a conservative method for valuing assets because it estimates the true amount the seller would receive net of costs if the asset were to be sold. Two of the largest assets that a company may list on a balance sheet are accounts receivable and inventory. NRV is used to value both of these asset types. Generally accepted accounting principles require that inventory be valued at the lesser amount of its laid-down cost and the amount for which it can likely be sold—its net realizable value(NRV).

ACCOUNTING

This amount is entered in accounts as “Provision for Doubtful Debts”. For financial reporting purposes the allowance method is preferred since it means the loss (bad debts expense) is recognized closer to the time of the credit sales.NRV, in the context of inventory, is the estimated selling price in the normal course of business, less reasonably predictable costs of completion, disposal, and transportation. Obviously, these measurements can be somewhat subjective, and may require the exercise of judgment in their determination. Now, let’s assume that a company’s inventory has a cost of $15,000. However, at the end of the accounting year the inventory can be sold for only $14,000 after it spends $2,000 for packaging, sales commissions, and shipping.

This also means that the balance sheet will be reporting a lower, more realistic amount of its accounts receivable sooner. In practice, it would be impracticable to determine the fair market value of all the assets and liabilities held by a corporation. Critics of the approach believe investor-analysts would have trouble determining which values are based on historical cost versus their replacement cost.