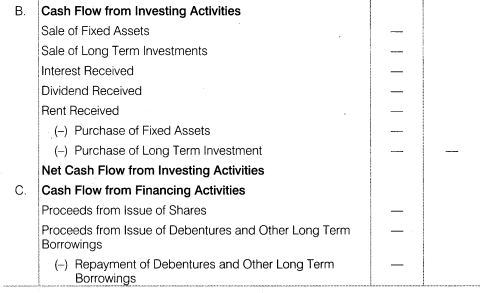

Overview of Key Elements of the BusinessInvesting activities include cash activities related to noncurrent assets. Financing activities include cash activities related to noncurrent liabilities and owners’ equity. The operating cash flows component of the cash flow statement refers to all cash flows that have to do with the actual operations of the business. It refers to the amount of cash a company generates from the revenues it brings in, excluding costs associated with long-term investment on capital items or investment in securities (these are investing or financing activities).

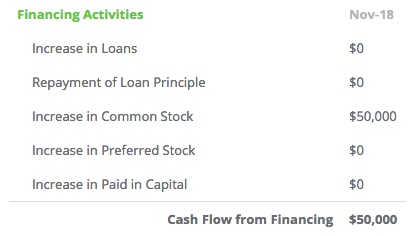

Transactions That Cause Negative Cash Flow From Financing Activities

General Accepted Accounting Principles (GAAP), non-cash activities may be disclosed in a footnote or within the cash flow statement itself. Non-cash financing activities may include leasing to purchase an asset, converting debt to equity, exchanging non-cash assets or liabilities for other non-cash assets or liabilities, and issuing shares in exchange for assets.

Corporate Cash Flow: Understanding the Essentials

In addition to the financing activities section, the operating and investing activities of a company are also reported. GAAP differs from International Financial Reporting Standards in that IFRS allows cash paid out to shareholders to be reported as either an operating activity or a financing activity. Cash flows from operating activities are among the major subsections of thestatement of cash flows. Operating activities are the functions of a business directly related to providing its goods and/or services to the market.It’s important for accountants, financial analysts, and investors to understand what makes up this section of the cash flow statement and what financing activities include. Since this is the section of the statement of cash flows that indicates how a company funds its operations, it generally includes changes in all accounts related to debt and equity.

What is Cash Flow from Financing Activities?

To summarize other linkages between a firm’s balance sheet and cash flow from financing activities, changes in long-term debt can be found on the balance sheet, as well as notes to the financial statements. Dividends paid can be calculated from taking the beginning balance of retained earnings from the balance sheet, adding net income, and subtracting out the ending value of retained earnings on the balance sheet. This equals dividends paid during the year, which is found on the cash flow statement under financing activities. Cash from operating activities usually refers to the first section of the statement of cash flows. Cash from operating activities focuses on the cash inflows and outflows from a company’s main business activities of buying and selling merchandise, providing services, etc.

What is cash flow from financing activities?

Cash Flow from Financing Activities is the net amount of funding a company generates in a given time period used to finance its business. Finance activities include the issuance and repayment of equity. Book value of equity is the difference between assets and liabilities, payment of dividends.Some cash flows relating to investing or financing activities are classified as operating activities. For example, receipts of investment income (interest and dividends) and payments of interest to lenders are classified as investing or financing activities. Conversely, some cash flows relating to operating activities are classified as investing and financing activities. Likewise a gain or loss on the payment of debt would generally be part of the cash outflow to the repayment of the amount borrowed, and therefore it is a financing activity. Non-cash investing and financing activities are disclosed in footnotes to the financial statements.

Cash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends. As is the case with operating and investing activities, not all financing activities impact the cash flow statement — only those that involve the exchange of cash do.

How Do the Balance Sheet and Cash Flow Statement Differ?

There is typically an operating activities section of a company’s statement of cash flows that shows inflows and outflows of cash resulting from a company’s key operating activities. The three sections of Apple’s statement of cash flows are listed with operating activities at the top and financing activities at the bottom of the statement (highlighted in orange). A company’s CFF activities refer to the cash inflows and outflows resulting from the issuance of debt, the issuance of equity, dividend payments and the repurchase of existing stock. It’s important to investors and creditors because it depicts how much of a company’s cash flow is attributable to debt financing or equity financing, as well as its track record for paying interest, dividends and other obligations. A firm’s cash flow from financing activities relates to how it works with the capital markets and investors.

- Essentially, the cash flow statement is concerned with the flow of cash in and out of the business.

- Some cash flows relating to investing or financing activities are classified as operating activities.

- The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement.

Applications in Financial Modeling

The balance sheet provides an overview of a company’s assets, liabilities, and owner’s equity as of a specific date. The income statement provides an overview of company revenues and expenses during a period. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period. The three categories of cash flows are operating activities, investing activities, and financing activities.Assume you are the chief financial officer of T-Shirt Pros, a small business that makes custom-printed T-shirts. While reviewing the financial statements that were prepared by company accountants, you discover an error. During this period, the company had purchased a warehouse building, in exchange for a $200,000 note payable.

What Is Cash Flow From Financing Activities?

Which is an example of a cash flow from a financing activity?

Cash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends.Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement.Essentially, it is the difference between the cash generated from customers and the cash paid to suppliers. When a company pays out dividends to its shareholders, this action is considered a financing activity under GAAP. Because of this, it is reported as such on the company’s statement of cash flows.

These are the company’s core business activities, such as manufacturing, distributing, marketing, and selling a product or service. Operating activities will generally provide the majority of a company’s cash flow and largely determine whether it is profitable. Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. These activities can be found on a company’s financial statements and in particular the income statement and cash flow statement.However, because no cash changes hands, the discount does not appear on the cash flow statement. Financing activities include the inflow of cash from investors, such as banks and shareholders and the outflow of cash to shareholders as dividends as the company generates income. Other activities that impact the long-term liabilities and equity of the company are also listed in the financing activities section of the cash flow statement. Operating activities are the daily activities of a company involved in producing and selling its product, generating revenues, as well as general administrative and maintenance activities. The operating income shown on a company’s financial statements is the operating profit remaining after deducting operating expenses from operating revenues.

Cash Flow in the Financial Statement

The company’s policy is to report noncash investing and financing activities in a separate statement, after the presentation of the statement of cash flows. This noncash investing and financing transaction was inadvertently included in both the financing section as a source of cash, and the investing section as a use of cash.