For example, the payback period on a home improvement project can be decades while the payback period on a construction project may be five years or less. Unlike other methods of capital budgeting, the payback period ignores the time value of money (TVM). This is the idea that money is worth more today than the same amount in the future because of the earning potential of the present money. Also, the method does not take into account the cash flows post the return of investment. Some projects may generate higher cash flows in the later life of the project. Considering that the payback period is simple and takes a few seconds to calculate, it can be suitable for projects of small investments.

So, if an investment of $200 has an annual return of $100, the ROI will be 50%, whereas the payback period will be 2 years ($200/$100). Ideally, businesses would pursue all projects and opportunities that hold potential profit and enhance their shareholder’s value. However, there’s a limit to the amount of capital and money available for companies to invest in new projects. And this amount is divided by the “Cash Flow in Recovery Year”, which is the amount of cash produced by the company in the year that the initial investment cost has been recovered and is now turning a profit.

Payback Period: Definition, Formula & Examples

The project is expected to return $1,000 each period for the next five periods, and the appropriate discount rate is 4%. The discounted payback period calculation begins with the -$3,000 cash outlay in the starting period. Next, assuming the project starts with a large cash outflow, or investment to begin the project, the future discounted cash inflows are netted against the initial investment outflow. The discounted payback period process is applied to each additional period’s cash inflow to find the point at which the inflows equal the outflows.

- The method is extremely simple to understand, as it only requires one straightforward calculation.

- Positive cash flow that occurs during a period, such as revenue or accounts receivable means an increase in liquid assets.

- The discounted payback period calculation begins with the -$3,000 cash outlay in the starting period.

- First, we’ll calculate the metric under the non-discounted approach using the two assumptions below.

The payback method is used by individuals also to analyze investment decisions. The discounted payback period determines the payback period using the time value of money. The situation gets a bit more complicated if you’d like to consider the time value of money formula (see time value of money calculator). After all, your $100,000 will not be worth the same after ten years; in fact, it will be worth a lot less. Every year, your money will depreciate by a certain percentage, called the discount rate.

What Are Some of the Downsides of Using the Payback Period?

Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

What Is the Discounted Payback Period?

Discounted payback period will usually be greater than regular payback period. Investments with higher cash flows toward the end of their lives will have greater discounting. It can help to use other metrics in financial decision making such as DCF analysis, or the internal rate of return (IRR), which is the discount rate that makes the NPV of all cash flows of an investment equal to zero. The discounted payback period is the number of years it takes to pay back the initial investment after discounting cash flows. In Excel, create a cell for the discounted rate and columns for the year, cash flows, the present value of the cash flows, and the cumulative cash flow balance.

Discounted payback period formula

The trouble with piling all of the calculations into a formula is that you can’t easily see what numbers go where or what numbers are user inputs or hard-coded. Next, the second column (Cumulative Cash Flows) tracks the net gain/(loss) to date by adding the current year’s cash flow amount to the net cash flow balance from the prior year. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

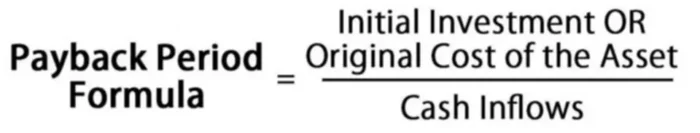

First, it ignores the time value of money, which is a critical component of capital budgeting. For example, three projects can have the same payback period; however, they could have varying flows of cash. The Payback Period Calculator can calculate payback periods, discounted payback periods, average returns, and schedules of investments. In addition, the potential returns and estimated payback time of alternative projects the company could pursue instead can also be an influential determinant in the decision (i.e. opportunity costs). As the equation above shows, the payback period calculation is a simple one. It does not account for the time value of money, the effects of inflation, or the complexity of investments that may have unequal cash flow over time.

How to Calculate Payback Period (Step-by-Step)

The study of cash flow provides a general indication of solvency; generally, having adequate cash reserves is a positive sign of financial health for an individual or organization. One of the most important concepts every corporate financial analyst must learn is how to value different investments or operational projects to determine the most profitable project or investment to undertake. The breakeven point is a specific price or value that an investment or project must reach so that the initial cost of that investment or project is completely returned. Whereas the payback period refers to the time it takes to reach the breakeven point. But there are a few important disadvantages that disqualify the payback period from being a primary factor in making investment decisions.

In most cases, this is a pretty good payback period as experts say it can take as much as years for residential homeowners in the United States to break even on their investment. It is based on a very simple need to get back at least how much has been spent. In fact, even as individuals when we invest in shares, mutual funds our first question is always about the time period within which we will get back our invested money. Despite its drawbacks, the payback method is the simplest method to analyze different project/investments. The Payback Period method does not take into account the time value of money and treats all flows at par. For example, Rs.1,00,000 invested yearly to make an investment of Rs.10,00,000 over a period of 10 years may seem profitable today but the same 1,00,000 will not hold the same value ten years later.