The Basics of Options ProfitabilityBuying three call options will cost $900 (3 contracts x 100 shares x $3). A call option writer stands to make a profit if the underlying stock stays below the strike price.This put would have intrinsic value — money you could get if the option was exercised — if the stock declines below $30. If you are a call or put buyer, picking the wrong strike price may result in the loss of the full premium paid. This risk increases the further away the strike price is from the current market price, i.e. out of the money.

The Essential Options Trading Guide

However, XYZ also has three-month calls available with a strike price of $95 for a cost $3. Now, instead of buying the shares, the investor buys three call option contracts.These factors include the current market price of the underlying security, time until the expiration date, and the value of the strike price in relationship to the security’s market price. Typically, the premium shows the value market participants place on any given option. An option that has value will likely have a higher premium associated with it versus one that has little chance of making money for an investor. A series of put options with different expiration dates and strike prices will trade against a single stock.

Beginners Guide To Options Strategies

A naked put, also called an uncovered put, is a put option whose writer (the seller) does not have a position in the underlying stock or other instrument. This strategy is best used by investors who want to accumulate a position in the underlying stock, but only if the price is low enough. If the buyer fails to exercise the options, then the writer keeps the option premium. That allows the exerciser (buyer) to profit from the difference between the stock’s market price and the option’s strike price. But if the stock’s market price is above the option’s strike price at the end of expiration day, the option expires worthless, and the owner’s loss is limited to the premium (fee) paid for it (the writer’s profit).

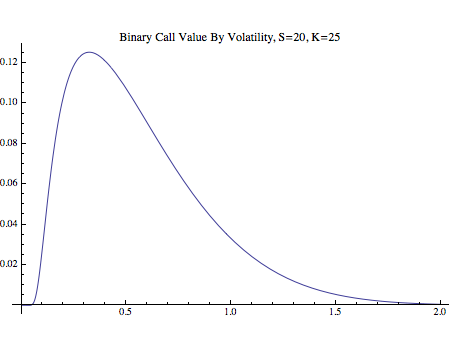

Call Price

While the deep money option carries a lower capital outlay and risk; they are not without risk. Remember that put sellers understood the risk and demanded huge premiums for buyers being foolish enough to sell those options. Investors who felt the need to buy puts at any price were the underlying cause of the volatility skew at the time. For example, say an investor has $900 to use on a particular trade and desires the most bang-for-the-buck.An in the money put option means that the strike price is above the market price of the prevailing market value. An investor holding an ITM put option at expiry means the stock price is below the strike price and it’s possible the option is worth exercising.

Why do preferred stocks have a face value that is different than market value?

A put option buyer is hoping the stock’s price will fall far enough below the option’s strike to at least cover the cost of the premium for buying the put. For example, a single call option contract may give a holder the right to buy 100 shares of Apple stock at $100 up until the expiry date in three months. There are many expiration dates and strike prices for traders to choose from. As the value of Apple stock goes up, the price of the option contract goes up, and vice versa.

- A naked put, also called an uncovered put, is a put option whose writer (the seller) does not have a position in the underlying stock or other instrument.

- This strategy is best used by investors who want to accumulate a position in the underlying stock, but only if the price is low enough.

- If the buyer fails to exercise the options, then the writer keeps the option premium.

Should I buy ITM or OTM calls?

Calculate the call price by calculating the cost of the option. The bond has a par value of $1,000, and a current market price of $1050. This is the price the company would pay to bondholders. The difference between the market price of the bond and the par value is the price of the call option, in this case $50.When you purchase a call, you pay a premium for the right to buy the underlying security. Depending upon the movement of the underlying stock, you can sell the call position to close prior to option expiration day for a premium that is either higher or lower than your purchase price. Many factors, including how much time remains until options expiration day (time decay), impact the price. Options traders can profit by being an option buyer or an option writer.

MANAGING YOUR MONEY

How is call price calculated?

A call price (also known as “redemption price”) is the price at which the issuer can redeem a bond or a preferred stock. This price is set at the time the security is issued.When the options trader is bearish on particular security, he can purchase put options to profit from a slide in asset price. The price of the asset must move significantly below the strike price of the put options before the option expiration date for this strategy to be profitable. When you buy a put option, you’re hoping that the price of the underlying stock falls. By buying a put option, you limit your risk of a loss to the premium that you paid for the put. Just like when buying and selling shares of stock, you realize a profit or loss when you sell to close a call option contract.Options allow for potential profit during both volatile times, and when the market is quiet or less volatile. This is possible because the prices of assets like stocks, currencies, and commodities are always moving, and no matter what the market conditions are there is an options strategy that can take advantage of it. However, an investor holding a call option that’s expiring in the money can exercise it and earn the difference between the strike price and market price. Whether the trade was profitable or not depends on the investor’s total expense of buying the contract and any commission to process that transaction.In the case of a call writer, the wrong strike price for the covered call may result in the underlying stock being called away. Some investors prefer to write slightly OTM calls to give them a higher return if the stock is called away, even if means sacrificing some premium income. With GE trading at $27.20, Carla thinks it can trade up to $28 by March; in terms of downside risk, she thinks the stock could decline to $26. She, therefore, opts for the March $25 call (which is in-the-money) and pays $2.26 for it. As shown in Table 1, this call has an intrinsic value of $2.20 (i.e. the stock price of $27.20 less the strike price of $25) and the time value of $0.06 (i.e. the call price of $2.26 less intrinsic value of $2.20).

Using Options for Tax Management

Put options with higher strike prices will have higher prices to purchase. Puts for more distant expiration dates are more expensive because there is more time for the stock to move and make the put purchase profitable. One put option is for 100 shares, so the cost of one contract is 100 times the quoted price.Spreading will offset the premium paid because the sold option premium will net against the options premium purchased. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Spreads can be created to take advantage of nearly any anticipated price action, and can range from the simple to the complex. As with individual options, any spread strategy can be either bought or sold.Of course, the risk with buying the calls rather than the shares is that if XYZ had not traded above $95 by option expiration, the calls would have expired worthless and all $900 would be lost. In fact, XYZ had to trade at $98 ($95 strike price + $3 premium paid), or about 9% higher from its price when the calls were purchased, for the trade just to breakeven. When the broker’s cost to place the trade is also added to the equation, to be profitable, the stock would need to trade even higher. Often times, traders or investors will combine options using a spread strategy, buying one or more options to sell one or more different options.

What Is a Call Option?

Call options allow for the buying of the underlying asset at a given price before a stated date. The premium comes into play when determining whether an option is in the money or not, but can be interpreted differently depending on the type of option involved. A call option is in the money if the stock’s current market price is higher than the option’s strike price. The amount that an option is in the money is called the intrinsic value meaning the option is at least worth that amount. Options come with an upfront fee cost—called the premium—that investors pay to buy the contract.