The Importance of Consolidated Financial StatementsA company would much rather be known for its sponsorship of a benefit charity event than for poisoning a local river, whatever its other attributes. Annual reports, then, can be invaluable tools in burnishing a company’s public image. Many annual reports discuss community initiatives undertaken by the company, including community renovation projects, charitable contributions, volunteer efforts, and programs to help protect the environment. The objective is to present the company as a proactive member of the community.

Selected Financial Data

Financial consolidation software is typically used to prepare consolidated financial reports because it is not as simple as adding up the financial statements from each subsidiary. In the consolidated report, the transactions among subsidiaries or a subsidiary and a parent company are eliminated to avoid double counting. For example, if a parent company purchases goods or services from a subsidiary, the parent company’s purchase and the subsidiary’s sale are both eliminated so this transaction doesn’t distort the final figures.

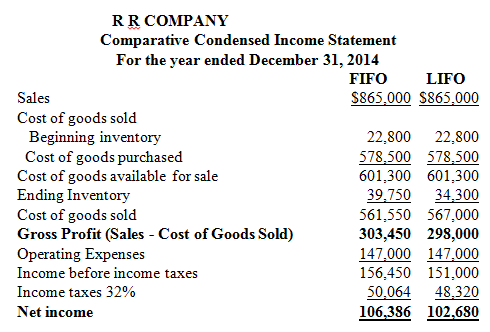

Preparing a Condensed Statement

In other words, the consolidated financial statements agglomerates the results of the subsidiary businesses into the parent company’s income statement, balance sheet and cash flow statement. In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 20X0, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived. Reducing Paperwork – With consolidated financial statements, there is also less paperwork involved. If the parent company owns nine subsidiaries, there are 40 separate standalone financial reports to view i.e. the four basic financial statements for each subsidiary plus the parent company. Not only would it be hard to track down all these records, it would be extremely difficult to look over each of them and try to get an overall view of how the business is performing.

Condensed Versus Complete

The auditor should report on such condensed financial information in the same manner as he reports on other supplementary schedules. Condensed financial statements are a summary form of a company’s earnings statement, balance sheet, and cash flow statement. These statements are created to provide a quick overview of the company’s financial status. Items that would normally receive several line items are condensed into one line, such as cost of goods sold or retained earnings. Disclosures that would be found in full financial statements are eliminated.

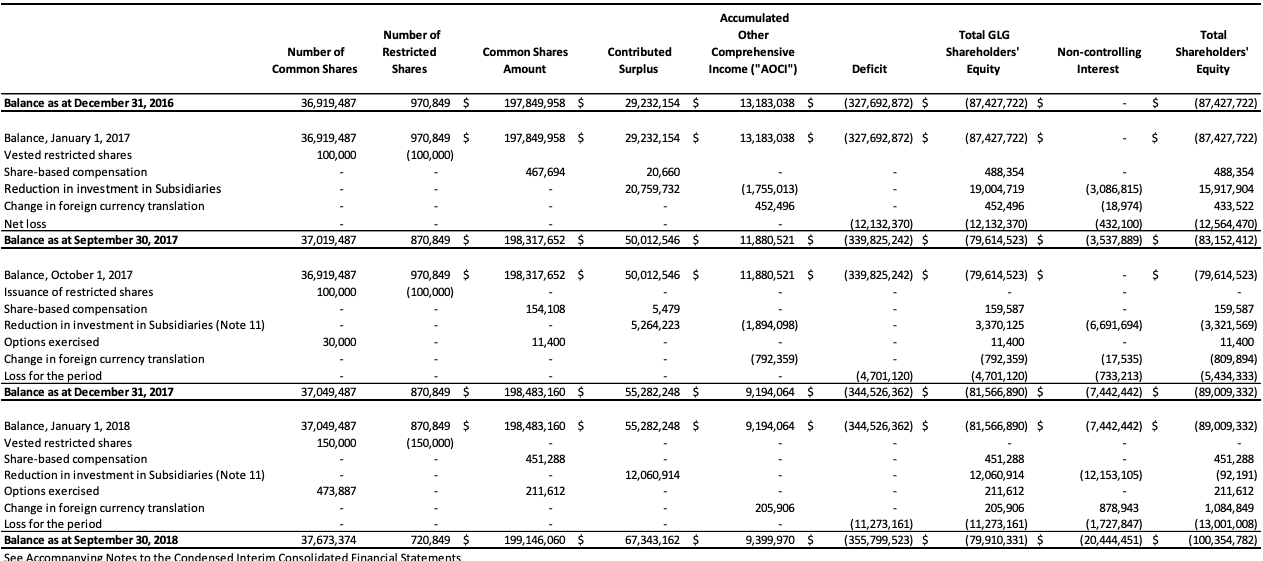

The Difference Between Cash Flow and EBITDA

Each subsidiary must prepare its own financial statements including balance sheet, income statement, statement of cash flows and statement of retained earnings. This information for each subsidiary is then combined using consolidation software to create consolidated financial reports that represent the financial position of the parent company. Under the equity method of accounting, your company’s investments in other businesses are reported on financial statements with more detail than is required for the stocks you hold that don’t give you the ability to exert significant influence. Initially, your equity investment is reported on the balance sheet at cost.Consolidated financial statements cut this pile of reports down to just four consolidated reports. This results in less paperwork and less effort being expended to assess a parent company’s financial health.In our opinion, the information set forth in the selected financial data for each of the five years in the period ended December 31, 20X5, appearing on page xx, is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived. Updates to Consolidated Financial Statements – Over time, consolidated financial statements will continue to evolve to make the process of evaluating a parent company even more transparent. One of the reasons for this is that in the past some companies have used consolidated reports to hide losses and liabilities in special subsidiaries that were created specifically for hiding these financial problems. The Financial Accounting Standards Board and the International Accounting Standards Board regularly revisit the definitions and requirements for consolidated statements in order to make them more reliable and easier to use.

What is the difference between combined and consolidated financial statements?

An interim financial report is a complete or condensed set of financial statements for a period shorter than a financial year. It also specifies the accounting recognition and measurement principles applicable to an interim financial report.This creates a total income and expenses for the entire group of companies, including the parent. For investors, a company’s financial statements offers insight into the health of the company. Depending on the size of a company and the complexity of its business, the financial statements may be a bit confusing, particularly if the company has several subsidiaries with overseas operations.Public companies are required to include the information needed for a comparative balance sheet analysis in their quarterly and annual reports to the SEC, though it can be useful to pull together more data on your own for a longer-term analysis. A combined financial statement shows financial results of different subsidiary companies from that of the parent company. An analysis of the importance of consolidated financial statements reveals these statements offer several benefits to investors, financial analysts and others who may be evaluating the health of the parent company. In this article, we will review consolidated financial reports in more detail including the unique benefits they offer. Since, the word ‘entity’ includes a company as well as any other form of entity, therefore, LLPs and partnership firms are required to be consolidated.

- Few major trends have shaken the tradition of annual reports, but one is the “summary annual report.” In 1987, the SEC eased its annual reporting requirements.

- In our opinion, the information set forth in the accompanying condensed consolidated financial statements is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived.

- It allowed companies to produce a summary annual report, rather than the traditional report with audited statements and footnotes.

Annual reports are formal financial statements that are published yearly and sent to company stockholders and various other interested parties. The reports assess the year’s operations and discuss the companies’ view of the upcoming year and the companies’ place and prospects. Both for-profit and not-for-profit organizations produce annual reports. Both combined and consolidated financial statements add the subsidiary companies’ income and expenses to the parent company.

Footnotes (AS 3315 – Reporting on Condensed Financial Statements and Selected Financial Data):

It can be quite tedious to do this manually but consolidated software simplifies the preparation of the final reports. According to GAAP (Generally Accepted Accounting Principles), parent companies must prepare consolidated financial statements to report on the financial well-being of both the parent company and all its subsidiaries. A comparative balance sheet analysis is a method of analyzing a company’s balance sheet over time to identify changes and trends.Since its use was approved, however, the summary annual report has not gained widespread support. Consolidated financial statements aggregate the financial position of a parent company and its subsidiaries. This allows an investor to check the overall health of the company in a holistic manner rather than viewing the individual company’s financial statements separately.

If you receive a $10,000 dividend payment during a year the business reports net income of $50,000, the amount reported on the balance sheet decreases to $90,000 for the dividend payment, but increases by $15,000 for your 30-percent share of its reported net income. 3SEC regulations require certain registrants to include in filings, as a supplementary schedule to the consolidated financial statements, condensed financial information of the parent company.

Combined Financial Statements

Each dividend payment you receive reduces the reported value of the investment, whereas it increases for your share of the net income reported by the company. To illustrate, suppose your company acquires a 30-percent ownership interest in a business for $100,000 cash.

How Do You Analyze a Bank’s Financial Statements?

What are condensed interim financial statements?

Thus, a typical condensed financial statement will usually contain one line for revenues, cost of goods sold, expenses, financing income and net income. Each line item on the condensed statement should match the total dollar amount for each subcategory found on the full financial statement.Similarly, under Accounting Standard (AS) 21, as per the definition of subsidiary, an enterprise controlled by the parent is required to be consolidated. The term ‘enterprise’ includes a company and any enterprise other than a company. Therefore, under AS also, LLPs and partnership firms are required to be consolidated. Companies invariably pay a great deal of attention to their reputation in the community or communities in which they operate, for their reputations as corporate citizens can have a decisive impact on bottom-line financial performance.A parent company with a controlling interest in a subsidiary consolidates the financial statements of its subsidiary into its own financial statement. 5If the auditor’s opinion on the complete financial statements was other than unqualified, the report should describe the nature of, and the reasons for, the qualification. The auditor should also consider the effect that any modification of the report on the complete financial statements might have on the report on the condensed financial statements or selected financial data. However, no reference to the inconsistency is necessary if a change in accounting referred to in the auditor’s report on the complete financial statements does not affect the comparability of the information being presented. .04 An auditor may be engaged to report on condensed financial statements that are derived from audited financial statements.This view of company financials helps provide an overview of the business structure and income performance. The condensed financial statements must adhere to Generally Accepted Accounting Principles and may at times be provided to interested parties in lieu of full financial statements. The auditing team conducting an audit of the company will usually view condensed financial statements along with full financial statements for a full picture of the company’s financial standing.In our opinion, the information set forth in the accompanying condensed consolidated financial statements is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived. Few major trends have shaken the tradition of annual reports, but one is the “summary annual report.” In 1987, the SEC eased its annual reporting requirements. It allowed companies to produce a summary annual report, rather than the traditional report with audited statements and footnotes. Promoters of the summary annual report see it as a way to make the annual report a true marketing publication without the cumbersome, detailed financial data. Financial data are still included, but in a condensed form in a supporting role.