Time Decay In OptionsThe put buyer either believes that the underlying asset’s price will fall by the exercise date or hopes to protect a long position in it. The put buyer’s prospect (risk) of gain is limited to the option’s strike price less the underlying’s spot price and the premium/fee paid for it. For example, a trader buys a call option for a premium of $1 on a stock with a strike price of $10. Near the expiration date of the option, the underlying stock is trading at $16.

Call Price

What is a call premium?

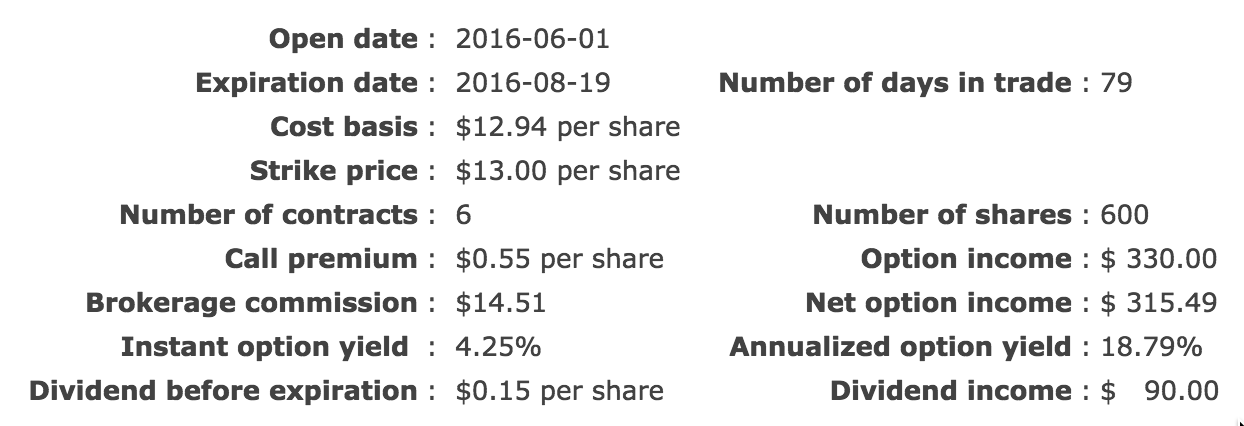

Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early by the issuer. In options terminology, the call premium is the amount that the purchaser of a call option must pay to the writer.When the stock price equals the strike price, the option contract has zero intrinsic value and is at the money. Therefore, there is really no reason to exercise the contract when it can be bought in the market for the same price. Assume an investor buys one call option contract on stock ABC with a strike price of $50 in May and a July expiration.

Call Premium for Options

July 60 put is a contract to sell 100 shares of Cisco for $60 each on or before the third Friday of the contract month, in this case July 21. It could be exercised profitably if the stock is at 55 because the holder would have paid for the right to sell the shares at 60 (the strike price), no matter what the current market price.

How is call premium calculated?

Call premiums may also be adjusted depending on how volatile a stock is. The premium, or cost of an option can be calculated with the following formula: Price = Intrinsic value + time value + volatility value. A call premium may decline as the expiration date of an option approaches.Instead of exercising the option and taking control of the stock at $10, the options trader will typically just sell the option, closing out the trade. As you learn about trading options, you’ll find that options traders use terms that are unique to options markets. Understanding what terms like strike price, exercise price, and expiration date mean is crucial for tradingoptions effectively.

Why Does a Call Price Matter?

In the derivatives market, the relationship between the price of the underlying asset and the strike price of the contract has important implications. This relationship is an important determinant of the value of the contract and, as expiration approaches, will be a deciding factor when considering whether the options contract should be exercised. Put options are most commonly used in the stock market to protect against a fall in the price of a stock below a specified price. In this way the buyer of the put will receive at least the strike price specified, even if the asset is currently worthless.When this happens, investors should understand how premiums are calculated. For bonds, investors need to know the face value of the bond, market volatility, and other factors that will determine the premium. For options, investors should know the intrinsic value, time value and volatility value that is used to calculate the cost of selling an option.The value of the contract that is not intrinsic value, is called extrinsic or time value. So, if the 50-strike call is trading $1.50 with the stock at $51, it has $1 of intrinsic value and 50 cents of time value. Thepremiumis paid up front at purchase and is not refundable – even if the option is not exercised.The relationship between the strike price and the actual price of a stock determines, in the unique language of options, whether the option is in-the-money, at-the-money or out-of-the-money. In addition, when the underlying stock’s price reaches the option contract’s strike price, the stock option is said to be at the money.An out-of-the-money call has a strike price that is higher than the current stock price; an out-of-the-money put has a strike price lower than the stock price. Call premiums are paid to investors as compensation for the risk of having a bond called early or an option sold.

- A naked put, also called an uncovered put, is a put option whose writer (the seller) does not have a position in the underlying stock or other instrument.

- This strategy is best used by investors who want to accumulate a position in the underlying stock, but only if the price is low enough.

- If the buyer fails to exercise the options, then the writer keeps the option premium.

You’ll see these terms appear often and understanding them can have a significant effect on your chances for profitability on an options trade. The components of an option premium include its intrinsic value, its time value and the implied volatility of the underlying asset. The strike price for an option is the price at which the underlying asset is bought or sold if the option isexercised.

What Are the Risks of Investing in a Bond?

However, let’s say that the stock rallies and at the end of the trading day, it closes at $50. The option contract is at the money because the stock price is equal to the strike price and has zero intrinsic value. Therefore, the put option also expires without being exercised because exercising it does not monetize any value.

Definition of ‘Premium’

Further, let’s suppose that it’s the day that the option contract expires (or the third Friday of July). At open, the stock is trading at $49 and the call option is out of the money—it does not have any intrinsic value because the stock price is trading below the strike price. However, at the close of the trading day, the stock price sits at $50. “Trader A” (Put Buyer) purchases a put contract to sell 100 shares of XYZ Corp. to “Trader B” (Put Writer) for $50 per share.Thus, a premium of $0.21 represents a premium payment of $21.00 per option contract ($0.21 x 100 shares). More time until the option’s expiration adds risk, and the person selling you that option will want to be paid a little more for that risk. As a result, if it’s June, a July option will be less expensive than a December option, and a June option will be cheaper than a July option.On the other hand, assume another trader bought one put option contract on stock ABC with a strike price of $50 and a July expiration. On expiration day, if the stock is trading at $49 (below the strike price) in the morning, the option is in the money because it has $1 of intrinsic value of one dollar ($50 – $49).

Are You Being Rewarded for the Investment Risk You’re Taking On?

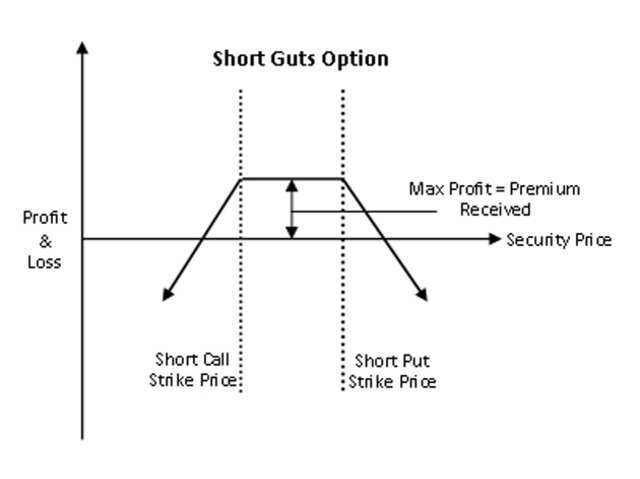

The current price is $50 per share, and Trader A pays a premium of $5 per share. If the price of XYZ stock falls to $40 a share right before expiration, then Trader A can exercise the put by buying 100 shares for $4,000 from the stock market, then selling them to Trader B for $5,000.First and foremost, it happens when you buy an option, and then sell the opposite type of option. This would occur by buying a call and selling a put OR buying a put and selling a call.

Call Premium for Bonds and Preferred Shares

A naked put, also called an uncovered put, is a put option whose writer (the seller) does not have a position in the underlying stock or other instrument. This strategy is best used by investors who want to accumulate a position in the underlying stock, but only if the price is low enough. If the buyer fails to exercise the options, then the writer keeps the option premium. That allows the exerciser (buyer) to profit from the difference between the stock’s market price and the option’s strike price. For example, if the stock is trading $51 and the strike price of a call option is $50, the investor can exercise the call, buy the stock for $50, sell it in the market at $51, and extract $1 of intrinsic value.