Everyone loves money, but if you really like to keep track of your money, pay bills and balance your checkbook, then an Accounts Payable will help to achieve this.

Accounts Payable Definition

What are accounts payable? According to the accounts payable definition, this is the money an individual or business entity has to pay another business or individual for the product or service they already received. It is the money that a company owes to vendors for products and services purchased on credit extended in the normal course of business. People can often refer to accounts payable as “payables.”

Example of an Account Payable

Let’s say Bob is selling some stuff. For him to sell his product, he needs a buyer. So, we have Tom who is buying. Tom has some cash sitting in the bank, and he does not want to trade cash for the product, or he doesn’t want to write a check. Tom wants to pay on account or terms. This means he will set up an account with the seller, Bob. Bob and Tom agree that Tom will pay in 30 days instead of today. The seller might also sell it on terms 2/10 Net 30, which means that Tom will get a 2% discount if he pays within 10 days. As a result of this transaction, Tom will have the product on his hands, and Bob will have a sales invoice. Bob will record the transaction under the Sales and Accounts Receivable account because he is expecting to receive the money. Tom will record the same sales invoice (bill) under Supplies (or another asset account, depending on the product purchased) and Accounts Payable because he still has to pay for the product he purchased. As you can see, it is easy to tell accounts payable vs. receivable.

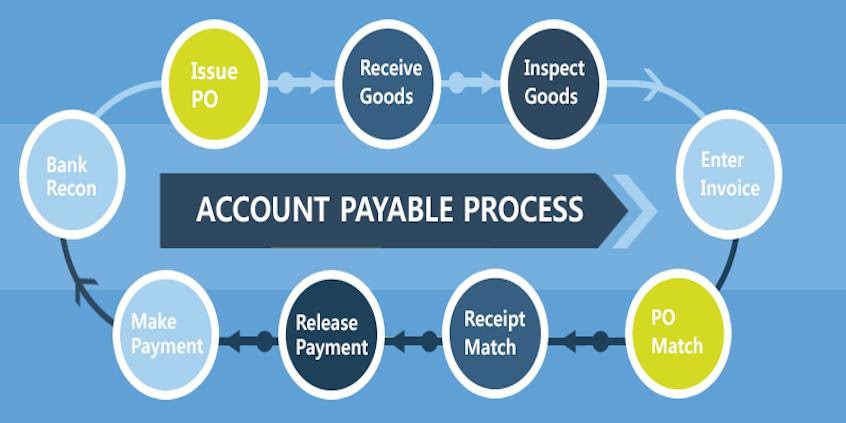

How to Record Accounts Payable

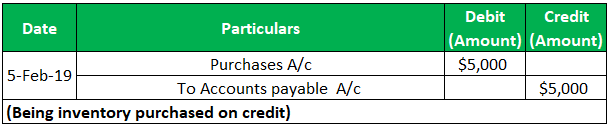

Accounts payable is presented as Current Liabilities under the Liability section of the Balance Sheet. Accounts payable process of recording the transaction starts with a determination of the other account involved in this transaction.Depending on the product or service purchased, the accountant will record the transaction under one of the Asset accounts because the company acquired something. Examples of such asset accounts include supplies, inventory, insurance, etc.The other account will always be the Accounts Payable account. The accountant can record all the purchases under one Accounts Payable account or create different accounts, such as Rent Payable and Insurance Payable. We will credit these payable accounts to increase them (when an invoice is identified as payable) and debit to decrease (when the business makes a payment for the invoice received).

Accounts Payable vs. Accounts Receivable

Just because the Accounts Receivable is on the other side of the accounting equation, it does not make it equal to the Accounts Payable. So, what is the difference between accounts payable and accounts receivable?As a general practice, suppliers offer to their customer’s credit, which is a payment arrangement to pay for a product or service after it has already been received. The supplier will create an accounts receivable account to record these sales on credit. As the name suggests, this account will keep track of the money that the supplier has yet to receive. The customer will create an accounts payable account to keep track of how much money he/she owes (has to pay) to the supplier. In other words, accounts payable means that it is someone else’s money and not your personal/business money. Both the accounts payable and accounts receivable accounts will decrease as the customers pay a portion of or all the money owed.