When Would a Bond Be Called?

How To Evaluate Bond Performance

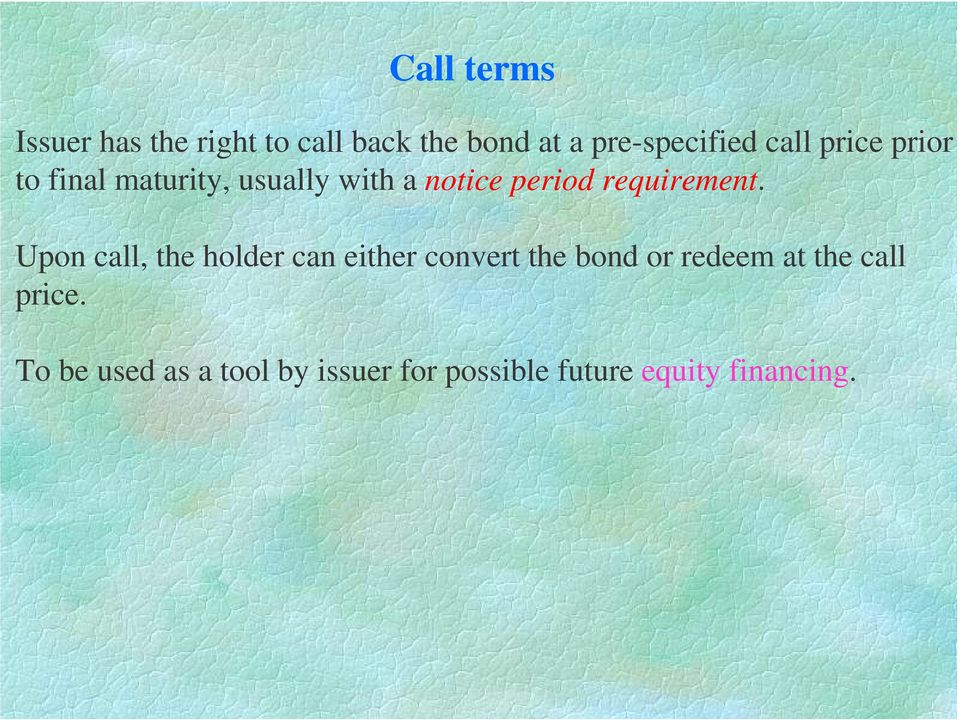

Callable bonds are more risky for investors than non-callable bonds because an investor whose bond has been called is often faced with reinvesting the money at a lower, less attractive rate. As a result, callable bonds often have a higher annual return to compensate for the risk that the bonds might be called early. Callable bonds typically pay a higher coupon or interest rate to investors than non-callable bonds. The companies that issue these products benefit as well. Should the market interest rate fall lower than the rate being paid to the bondholders, the business may call the note.

Start-up businesses have a high failure rate when compared with larger, well-established firms. Consequently, small companies typically have to pay higher rates on loans and bonds than more established firms.This phenomenon is called price compression and is an integral aspect of how callable bonds behave. An issuer may choose to call a bond when current interest rates drop below the interest rate on the bond. That way the issuer can save money by paying off the bond and issuing another bond at a lower interest rate. This is similar to refinancing the mortgage on your house so you can make lower monthly payments.As a result, a callable bond may not be appropriate for investors seeking stable income and predictable returns. As a general rule of thumb in investing it’s best to diversify your assets as much as possible. Callable bonds offer one tool to marginally enhance the rate of return over your overall fixed-income portfolio, but they do so with additional risk and represent a bet against lower interest rates. Those appealing short-term yields, can end up costing you in the long run.

A Beginner’s Guide to Embedded Options in Bonds

Bonds are loan agreements involving creditors and borrowers. Cities and corporations issue bonds with terms ranging from six months to 30 years. The bond issuer pays interest to the bondholders for the duration of the bond’s term. Typically, the interest rate is fixed for the entire term. A call feature enables the bond issuer to pay off the debt prior to the end of the term.In this scenario, not only does the bondholder lose the remaining interest payments but it would be unlikely they will be able to match the original 6% coupon. The investor might choose to reinvest at a lower interest rate and lose potential income. Also, if the investor wants to purchase another bond, the new bond’s price could be higher than the price of the original callable. In other words, the investor might pay a higher price for a lower yield.A callable bond allows the issuing company to pay off their debt early. A business may choose to call their bond if market interest rates move in a favorable direction and will allow them to borrow at a more beneficial rate. Callable bonds also benefit investors as they typically offer an attractive interest rate or coupon rate due to their callable nature. In addition to reinvestment-rate risk, investors must also understand that market prices for callable bonds behave differently than normal bonds. Typically as rates decrease, you will see bond prices increase, but this is not the case for callable bonds.On the other hand, I-bonds come with frustrating restrictions that may alienate seasoned investors or folks who have plenty of money to burn. Three years from the date of issuance, interest rates fall by 200 basis points (bps) to 4%, prompting the company to redeem the bonds.

What does call a bond mean?

Calculate the call price by calculating the cost of the option. The bond has a par value of $1,000, and a current market price of $1050. This is the price the company would pay to bondholders. The difference between the market price of the bond and the par value is the price of the call option, in this case $50.

They may then, refinance the debt at a lower interest rate. This flexibility is usually more favorable for the business than using bank-based lending.

- Cities and corporations issue bonds with terms ranging from six months to 30 years.

- Bonds are loan agreements involving creditors and borrowers.

- The bond issuer pays interest to the bondholders for the duration of the bond’s term.

When the call feature is activated, bondholders receive a return of premium as well as any interest that has accrued. Investors usually demand higher-than-average yields on callable bonds; the additional interest offsets some of the risk associated with lost income if the bond is called in. There is no free lunch, and the higher interest payments received for a callable bond come with the price of reinvestment-rate risk and diminished price-appreciation potential.

Dictionary of Financial Terms

The higher an entity’s credit rating, the more cheaply and easily it can borrow money. Therefore, many start-up firms issue callable bonds so that these debts can be refinanced with lower-cost bonds once the firm has improved its credit rating. Series I savings bonds offer impressive tax advantages, decent rates of return for guaranteed investments, and some protection against inflation. They’re also flexible, liquid, and easy to purchase or sell.

TAX CENTER

How do you calculate the call price of a bond?

A call price (also known as “redemption price”) is the price at which the issuer can redeem a bond or a preferred stock. This price is set at the time the security is issued.The company uses the proceeds from the second, lower-rate issue to pay off the earlier callable bond by exercising the call feature. As a result, the company has refinanced its debt by paying off the higher-yielding callable bonds with the newly-issued debt at a lower interest rate. A callable bond, also known as a redeemable bond, is a bond that the issuer may redeem before it reaches the stated maturity date.

Are Callable Bonds a Good Addition to the Portfolio?

Issuers entice investors to buy callable bonds by paying higher interest rates on callable bonds than on noncallable bonds. But the price of a callable bond will not rise much above its call price, no matter how low interest rates go, because dropping interest rates increase the likelihood that it will be called.

What the Call Price Means to Bondholders

Credit rating agencies regularly review the finances of bond issuers, including corporations and municipalities. Over the course of time, an entity can increase its credit rating by balancing its books and making debt payments on time.

Callable or Redeemable Bonds

However, these risks are related to decreases in interest rates and make callable bonds one of many tools for investors to express their tactical views on financial markets. (For further reading on investment diversification practices, check out Achieving Optimal Asset Allocation). If market interest rates decline after a corporation floats a bond, the company can issue new debt, receiving a lower interest rate than the original callable bond.