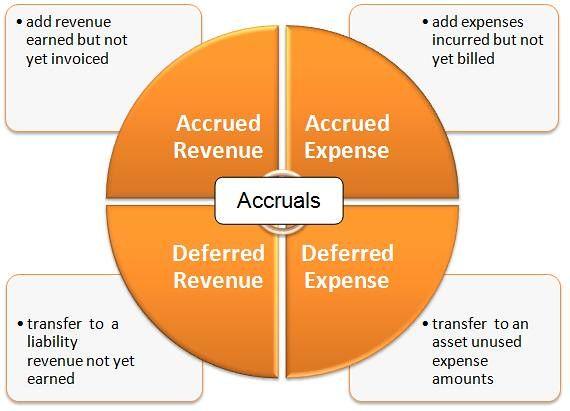

For the purpose of forming the financial result of the organization’s activities for the reporting period, income and expenses are differentiated between the reporting periods. Income and expenses related to this reporting period are reflected in the current income and expense accounts and participate in determining the financial result for this reporting period. If the income received (accrued) in the reporting period and expenses incurred related to the following reporting periods, they are not included in current income and expenses and are subject to accounting as part of the income and expenses of future periods.

Revenue Accruals and Deferrals

For an accounting of revenue received in the reporting period, but related to future periods, use the passive account “income of future periods.” For the loan, the accounts take into account income related to future periods, as well as upcoming receipts of arrears for shortfalls identified in the reporting period for previous years, and income arising from the excess of the value of the missing and damaged valuables recovered from the culprits over their book value. By debit, the accounts reflect the write-off of deferred income to the accounting accounts for the reporting period.

Expense: Accruals and Deferrals

The principles of accounting for deferred income also apply to account for deferred expenses.Deferred expenses are expenses incurred in this reporting period but related to future reporting periods. Expenses for future periods include:

- mining and preparatory works;

- preparatory works due to their seasonal nature;

- development of new production facilities, installations, and aggregates;

- land reclamation and other environmental protection measures;

- repairs of fixed assets made unevenly during the year (if the organization does not create an appropriate reserve);

- product certification;

- advertising; training;

- for the acquisition of licenses, etc.

Expenses related to future periods, as they arise, are reflected on the debit of the active account “expenses of future periods” in correspondence with the credit of different accounts, depending on the type of expenses incurred (“Materials,” “cash,” “Settlement accounts,” “social insurance and security Payments,” “Calculations with the personnel on payment,” “Settlements with various debtors and creditors,” etc.).

Accruals and Deferrals: Journal Entries

The sub-account “Income received for accrual and deferral” takes into account income received in the reporting period, but related to future reporting periods: rent and apartment fees, utility fees, revenue for cargo transportation, for passenger transportation on monthly and quarterly tickets, subscription fees for the use of communication facilities, etc. The received or accrued amounts of income are reflected on the credit of the sub-account in correspondence with the debit of cash and settlement accounts. At the beginning of the reporting period to which these revenues relate, they are written off in the entry to the income of the upcoming reporting period by debiting the sub-account 98-1 and crediting the corresponding current income accounts.

Deferred or Prepaid Expenses

The main task when accounting for expenses of future periods is to distinguish the expenses incurred by the organization for expenses and for assets, and then to allocate a separate independent object – expenses of future periods.Determining factors for the recognition of an asset is its control over the organization and the possibility of obtaining economic benefits from it, that is, cash inflows. And the economic benefits an asset will bring when it can be:

- used separately or in combination with another asset in the production of products, works, services intended for sale;

- exchanged for another asset;

- used to settle a liability account;

- distributed among the owners of the organization.

This definition allows you to attribute certain costs to expenses in future periods as an asset.And the accountant should create criteria for such attribution (by type of costs, taking into account the specifics of the industry) and fix them in the accounting policy.