Activity-Based ManagementIn traditional product costing system, costs are, first, traced not to activities but to an organisational unit, such as department or plant and then to products. ABC, as compared to traditional cost system is based on one fundamental difference. Under ABC, activity and product/service costs are determined based on the primary principle that activities consume resources (costs). Products and services (cost objects), in-turn, consume the activities. This principle is fundamentally different from traditional costing systems whose premise is that product/services consume resources directly, and activity costs are not calculated at all.

How is activity based management related to activity based costing?

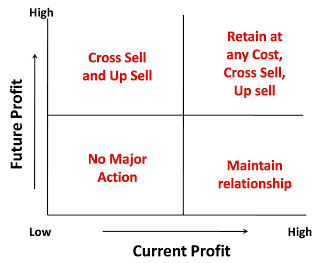

ABM helps to reduce customer response time by identifying activities that consume the most resources in value and time. ABM also helps in reducing customer response time by identifying and eliminating non-value added activities. This way the customer response time and cost will decline.

Consequently, managers were making decisions based on inaccurate data especially where there are multiple products. ABC focuses on the drivers which cause overheads and traces overheads to products in terms of usage of cost drivers. Therefore, under ABC, a large proportion of overheads are product related.

Is Your Company Budgeting for Capital Expenditures Correctly?

In traditional costing systems, however, most support overheads are assigned to products in general arbitrary manner and therefore cannot be related to products. ABC by identifying appropriate cost drivers and cost pools makes the product costs more accurate and reliable.

What Is Activity-Based Management?

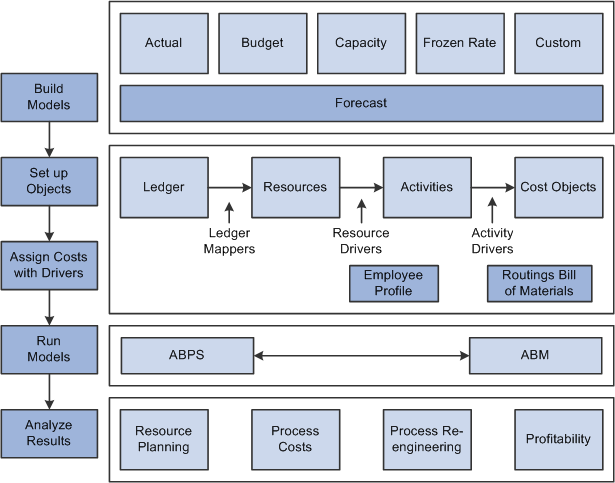

Activity-based costing establishes relationships between overhead costs and activities so that costs can be more precisely allocated to products, services, or customer segments. In a business organization, the ABC methodology assigns an organization’s resource costs through activities to the products and services provided to its customers. ABC is generally used as a tool for understanding product and customer cost and profitability based on the production or performing processes. As such, ABC has predominantly been used to support strategic decisions such as pricing, outsourcing, identification and measurement of process improvement initiatives.This model assigns more indirect costs (overhead) into direct costs compared to conventional costing. Activity-based costing (ABC) is a method of assigning overhead and indirect costs—such as salaries and utilities—to products and services.

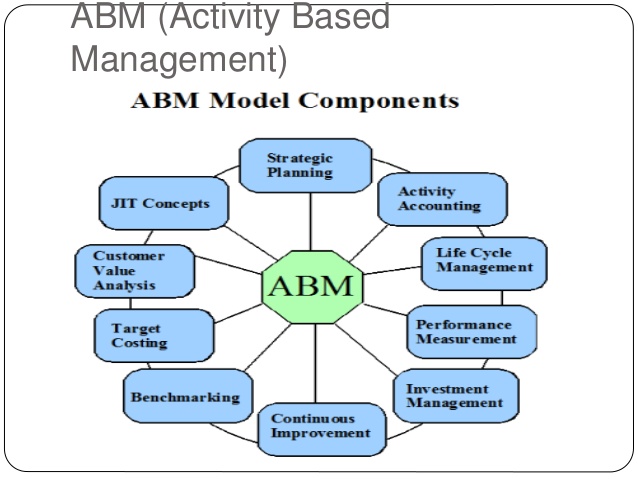

What is Cost of Quality (COQ)

The Activity-Based Costing (ABC) is a costing system which focuses on activities performed to produce products. ABC is that costing in which costs are first traced to activities and then to products.Rates based on these activities are then used to assign overhead to products in proportion to the amount of activity required to produce them. Activity-based costing typically uses more overhead allocation rates than the plantwide and departmental methods. Activity-based management (ABM) is a systematic, integrated approach that describes management decisions that use activity-based costing information to satisfy customers and improve profitability. ABM broadly includes aspects like pricing and product mix decisions, cost reduction and process improvement decisions and product design decisions. An overhead cost-allocation system that allocates overhead to multiple activity cost pools and assigns the activity cost pools to products or services by means of cost drivers that represent the activities used.

- Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services.

- However, some indirect costs, such as management and office staff salaries, are difficult to assign to a product.

- This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods.

Concretely, the total indirect cost of an activity is temporarily allocated to the medical services using each candidate of cost drivers. The difference between the costs calculated by each candidate and the proper cost driver used in ABC is calculated to evaluate the similarity by the evaluation function. Even in ABC, some overhead costs are difficult to assign to products and customers, such as the chief executive’s salary. These costs are termed ‘business sustaining’ and are not assigned to products and customers because there is no meaningful method.

NOTES: Chapter 17. Activity-Based Costing and Analysis

What is the role of activity based systems in the management cycle?

In accounting, activity based management (ABM) is a method of internal analysis that identifies business activities within a company then evaluates them based on the costs incurred by the activities and the value added by the activities. The idea is to analyze the activities related to the company’s operations.Further, ABC, in this way, helps in better cost management and cost control by managing the activities which cause costs. A lot of the information gathered in activity-based management is derived from information gathered from another management tool, activity-based costing (ABC). Whereas activity-based management focuses on business processes and managerial activities driving organizational business goals, activity-based costing seeks to identify and reduce cost drivers by optimizing resources. Having such information allows an organization to determine the potential savings to be gained by implementing process improvements.

Importance of ABM:

However, the workload of data collection of cost drivers can be time-consuming and a considerable burden if there are many cost drivers. The authors aim to develop a method for objectively reducing the cost drivers used in the ABC method. Robin Cooper and Robert S. Kaplan, proponents of the Balanced Scorecard, brought notice to these concepts in a number of articles published in Harvard Business Review beginning in 1988.Calculating the cost driver rate is done by dividing the $50,000 a year electric bill by the 2,500 hours, yielding a cost driver rate of $20. In the past, an ABM strategy was expensive; it required a lot of work and many components had tasks that needed to be done manually. In addition to traditional email promotions, this may involve creating and sharing information that is relevant to the potential customer’s business and stage in the buyer journey, a concept known as content marketing. In contrast, activity-based costing focuses on activities and the costs of carrying out activities.Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods. However, some indirect costs, such as management and office staff salaries, are difficult to assign to a product. Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.Cooper and Kaplan described ABC as an approach to solve the problems of traditional cost management systems. These traditional costing systems are often unable to determine accurately the actual costs of production and of the costs of related services.Activity-based costing can be considered an offshoot of activity-based management. Activity-based costing (ABC) is widely used to precisely allocate indirect costs to medical services. In the ABC method, the indirect cost is divided among the medical services in proportion to the volume of “cost drivers”, for example, labor hours and the number of hours of surgery.

Understanding Activity-Based Management (ABM)

This costing system assumes that activities are responsible for the incurrence of costs and products create the demands for activities. Costs are charged to products based on individual product’s use of each activity. Activity-based costing benefits the costing process by expanding the number of cost pools that can be used to analyze overhead costs and by making indirect costs traceable to certain activities. As an activity-based costing example, consider Company ABC that has a $50,000 per year electricity bill. For the year, there were 2,500 labor hours worked, which in this example is the cost driver.

Activity Based Management – Objectives

We assume that these activities and cost drivers are the best combination. Our method, that is cost driver reduction (CDR), can objectively select surrogates of the cost drivers for each activity in ABC from candidate cost drivers.