Audit Report ExamplesA disclaimer of opinion is a statement made by an auditor that no opinion is being given regarding the financial statements of a client. For example, the auditor may not have been allowed or been able to complete all planned audit procedures.

BUSINESS OPERATIONS

The second section identifies the financial statements on which the auditor’s opinion is given. A third section outlines the auditor’s opinion on the financial statements.The Securities and Exchange Commission (SEC) does not tolerate adverse opinions by auditors of public businesses; it would suspend trading in a company’s securities if the company received an adverse opinion from its CPA auditor. An auditor’s report is a written letter attached to a company’s financial statements that express its opinion on a company’s compliance with standard accounting practices. The auditor’s report is required to be filed with a public company’s financial statements when reporting earnings to the Securities and Exchange Commission (SEC).

Opinion Paragraph

An adverse opinion means that the auditor found that not only did the company not follow accounting guidelines, but there were discrepancies in the financials. An adverse opinion indicates that the auditor might have suspicions of material misstatements or misrepresentations in the financial statements, but does not have enough evidence to clearly express that opinion. An adverse opinion is the worst possible outcome for a company and can have a lasting impact and legal ramifications if not corrected. The auditor’s report is a document containing the auditor’s opinion of whether a company’s financial statements comply with GAAP. In the second section, the auditor explains its own responsibilities, duties and rights regarding the engagement.

Adverse Opinion

In an unqualified report, the auditors conclude that the financial statements of your business present fairly its affairs in all material aspects. The opinion embodies the assumptions that your business observed compliance with generally accepted accounting principles and statutory requirements. Also known as a clean report, such a report implies that any changes in the accounting policies, their application and effects, are adequately determined and divulged. Disclaimer report is given by auditors in which auditors distance themselves from giving any kind of opinion on the financial statements. This kind of audit opinion is considered very harsh and creates a very adverse image of the company.At the culmination of the audit engagement, the auditor expresses his opinion in the auditor’s report, which can be qualified or unqualified. The auditor reports an unqualified opinion if the financial statements are presumed to be free from material misstatements. In addition, an unqualified opinion is given over the internal controls of an entity if management has claimed responsibility for its establishment and maintenance, and the auditor has performed fieldwork to test its effectiveness. The audit report begins with an introductory section outlining the responsibility of management and the responsibility of the audit firm.The threat of an adverse opinion almost always motivates a business to give way to the auditor and change its accounting or disclosure in order to avoid getting the kiss of death of an adverse opinion. An adverse audit opinion says that the financial statements of the business are misleading.

Steps of the Audit Process

However, an auditor’s report is not an evaluation of whether a company is a good investment. Also, the audit report is not an analysis of the company’s earnings performance for the period. Instead, the report is merely a measure of the reliability of the financial statements. The auditor’s report is a written letter from the auditor containing the opinion of whether a company’s financial statements comply with generally accepted accounting principles (GAAP). The independent and external audit report is typically published with the company’s annual report.

- Also known as a clean report, such a report implies that any changes in the accounting policies, their application and effects, are adequately determined and divulged.

- The opinion embodies the assumptions that your business observed compliance with generally accepted accounting principles and statutory requirements.

- In an unqualified report, the auditors conclude that the financial statements of your business present fairly its affairs in all material aspects.

START YOUR BUSINESS

What is audit report definition?

An audit report is a written opinion of an auditor regarding an entity’s financial statements. The report is written in a standard format, as mandated by generally accepted auditing standards (GAAS). A qualified opinion, if there were any scope limitations that were imposed upon the auditor’s work.A qualified audit report does not mean that your business is suffering, and it doesn’t mean that your financial statement isn’t transparent. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. In the event that the auditor is unable to complete the audit report due to absence of financial records or insufficient cooperation from management, the auditor issues a disclaimer of opinion. This is an indication that no opinion over the financial statements was able to be determined.A qualified opinion is given when a company’s financial records have not followed GAAP in all financial transactions. A qualified opinion may be given due to either a limitation in the scope of the audit or an accounting method that did not follow GAAP.

AccountingTools

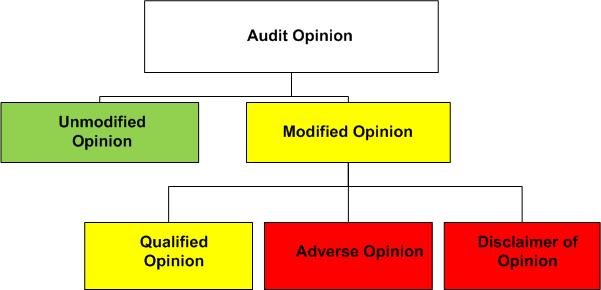

What are the 4 types of audit reports?

There are four types of audit reports: and unqualified opinion, a qualified opinion, and adverse opinion, and a disclaimer of opinion. An unqualified or “clean” opinion is the best type of report a business can get.Inaccurate or erroneous financial information cause audit legal implications. Auditors are responsible for making sure that all line items on financial statements are presented fairly. The audit reports ultimately affect business decisions of banks, government, investors, and other business-related entities. We do not express an opinion on the accompanying financial statements of the company.Often called a clean opinion, an unqualified opinion is an audit report that is issued when an auditor determines that each of the financial records provided by the small business is free of any misrepresentations. In addition, an unqualified opinion indicates that the financial records have been maintained in accordance with the standards known as Generally Accepted Accounting Principles (GAAP).The auditor’s report is important because banks and creditors require an audit of a company’s financial statements before lending to them. In this article, we explain what goes into an auditor’s report as well as review an example of an audit report. As a businessperson, you should keep in mind that there are deep-held perceptions about auditors’ opinions. Banks, investors and regulators such as the IRS rely on audited financial statements for their analytical needs. Stakeholders such as banks and investors view qualified audit report unfavorably.Therefore, you should hope to receive an unqualified audit report because it gives a positive impression of your business. If issues are material and pervasive, the auditor issues a disclaimer or adverse opinion.

FINANCE YOUR BUSINESS

Here, the auditor emphasizes the nature of the audit and states that the auditor only examines internal controls and accounting records on a sample basis. In the third section, the auditor gives his opinion on the financial statements. In an audit engagement, the auditor gives his opinion on the financial information disclosed by your business. The auditor’s report is an integral element of your business’s audited financial statement.Although it is not found in all audit reports, a fourth section may be presented as a further explanation regarding a qualified opinion or an adverse opinion. An Adverse Opinion is issued when the auditor determines that the financial statements of an audited company are materially misstated and, when considered as a whole, do not conform with Generally Accepted Accounting Principles (GAAP). An opinion is said to be unqualified when the Auditor concludes that the Financial Statements give a true and fair view in accordance with the financial reporting framework used for the preparation and presentation of the Financial Statements.However, the deviation from GAAP is not pervasive and does not misstate the financial position of the company as a whole. A Qualified Opinion report is issued when the auditor encountered one of two types of situations which do not comply with generally accepted accounting principles, however the rest of the financial statements are fairly presented. This type of opinion is very similar to an unqualified or “clean opinion”, but the report states that the financial statements are fairly presented with a certain exception which is otherwise misstated.