Does accumulated depreciation affect net income?

ACCOUNTING

For the December income statement at the end of the second year, the monthly depreciation is $1,000, which appears in the depreciation expense line item. For the December balance sheet, $24,000 of accumulated depreciation is listed, since this is the cumulative amount of depreciation that has been charged against the machine over the past 24 months.On the balance sheet, a company uses cash to pay for an asset, which initially results in asset transfer. Because a fixed asset does not hold its value over time (like cash does), it needs the carrying value to be gradually reduced. Depreciation expense gradually writes down the value of a fixed asset so that asset values are appropriately represented on the balance sheet.

Is accumulated depreciation an asset or liability?

Divide the depreciable base by the service life of the building to calculate the depreciation expense each year. Here, the expense is $9,375. Fill in your balance sheet. On the “Buildings” line in the “Property, Plant & Equipment” section, write the original cost of the building.

How to Calculate Building Depreciation

Depreciation expense flows through to the income statement in the period it is recorded. Accumulated depreciation is presented on the balance sheet below the line for related capitalized assets. The accumulated depreciation balance increases over time, adding the amount of depreciation expense recorded in the current period. Accumulated depreciation is the total amount an asset has been depreciated up until a single point. Each period, the depreciation expense recorded in that period is added to the beginning accumulated depreciation balance.Depreciation spreads the expense of a fixed asset over the years of the estimated useful life of the asset. The accounting entries for depreciation are a debit to depreciation expense and a credit to fixed asset depreciation accumulation. Each recording of depreciation expense increases the depreciation cost balance and decreases the value of the asset.

Subsequently, accumulated depreciation is the total amount of the asset that has been depreciated from the day of its purchase to the reporting date. The amount of accumulated depreciation for an asset increases over the lifetime of the asset, as depreciation expense continues to be charged against the asset which eventually decreases the carrying value of the asset. As such, accumulated depreciation can also help an accountant to track how much useful life is remaining for an asset. As an example, a company acquires a machine that costs $60,000, and which has a useful life of five years. This means that it must depreciate the machine at the rate of $1,000 per month.

Depreciation and Accumulated Depreciation Example

Over time, the amount of accumulated depreciation will increase as more depreciation is charged against the fixed assets, resulting in an even lower remaining book value. A company can increase the balance of its accumulated depreciation more quickly if it uses an accelerated depreciation over a traditional straight-line method.An accelerated depreciation method charges a larger amount of the asset’s cost to depreciation expense during the early years of the asset. Depreciation allows a company to divide the cost of an asset over its useful life, which helps prevent a significant cost from being charged when the asset is initially purchased.Accumulated depreciation allows investors and analysts to see how much of a fixed asset’s cost has been depreciated. Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset. This account is paired with the fixed assets line item on the balance sheet, so that the combined total of the two accounts reveals the remaining book value of the fixed assets.

What Is the Tax Impact of Calculating Depreciation?

- Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset.

- At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.

- Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets that are appropriate for the period.

Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income. For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited.

How do you calculate accumulated depreciation on a building?

Accumulated depreciation – buildings is the aggregate amount of depreciation that has been charged against the buildings asset. When a building is sold, the associated amount of accumulated depreciation is removed from the accumulated depreciation – buildings account.

How Are Accumulated Depreciation and Depreciation Expense Related?

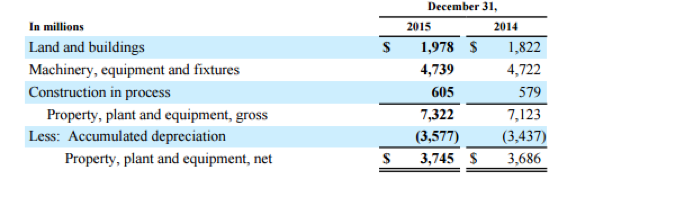

Depreciation is found on the income statement, balance sheet, and cash flow statement. It can thus have a big impact on a company’s financial performance overall. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. When recording depreciation in the general ledger, a company debits depreciation expense and credits accumulated depreciation.The use of a depreciation method allows a company to expense the cost of an asset over time while also reducing the carrying value of the asset. Initially, most fixed assets are purchased with credit which also allows for payment over time. The initial accounting entries for the first payment of the asset are thus a credit to accounts payable and a debit to the fixed asset account. Depreciation is an accounting method for allocating the cost of a tangible asset over time. Companies must be careful in choosing appropriate depreciation methodologies that will accurately represent the asset’s value and expense recognition.Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero. Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets that are appropriate for the period.An asset’s carrying value on the balance sheet is the difference between its historical cost and accumulated depreciation. At the end of an asset’s useful life, its carrying value on the balance sheet will match its salvage value. Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed assets like property, plant, and equipment are long-term assets. Depreciation expenses a portion of the cost of the asset in the year it was purchased and each year for the rest of the asset’s useful life.

Method 3 of 3: Retiring or Disposing of the Asset

As a result, accumulated depreciation is a negative balance reported on the balance sheet under the long-term assets section. Each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation account is credited for the same amount. Over the years, accumulated depreciation increases as the depreciation expense is charged against the value of the fixed asset.Each year the contra asset account referred to as accumulated depreciation increases by $10,000. For example, at the end of five years, the annual depreciation expense is still $10,000, but accumulated depreciation has grown to $50,000. It is credited each year as the value of the asset is written off and remains on the books, reducing the net value of the asset, until the asset is disposed of or sold. It is important to note that accumulated depreciation cannot be more than the asset’s historical cost even if the asset is still in use after its estimated useful life. Depreciation expense is a portion of the total capitalized asset that is recognized in the income statement from the year it is purchased and for the rest of the useful life of the asset.However, accumulated depreciation plays a key role in reporting the value of the asset on the balance sheet. Understanding and accounting for accumulated depreciation is an essential part of accounting. While the process can be moderately challenging, you can learn how to account for accumulated depreciation by following a few simple steps.Depreciation is an accounting measure that allows a company to earn revenue from the asset, and thus, pay for it over its useful life. As a result, the amount of depreciation expense reduces the profitability of a company or its net income. Accumulated depreciation is the total amount of depreciation expenses that have been charged to expense the cost of an asset over its lifetime.

How to Account For Accumulated Depreciation

By having accumulated depreciation recorded as a credit balance, the fixed asset can be offset. In other words, accumulated depreciation is a contra-asset account, meaning it offsets the value of the asset that it is depreciating.