Where is the premium or discount on bonds payable presented on the balance sheet?The central government soon observed the economic advantages of printing paper money, issuing a monopoly right of several of the deposit shops to the issuance of these certificates of deposit. By the early 12th century, the amount of banknotes issued in a single year amounted to an annual rate of 26 million strings of cash coins. By the 1120s the central government officially stepped in and produced their own state-issued paper money (using woodblock printing). Likewise, if interest rates soared to 15%, then an investor could make $150 from the government bond and would not pay $1,000 to earn just $100. This bond would be sold until it reached a price that equalized the yields, in this case to a price of $666.67.By this time, the notes were standardized in appearance and not too different from Federal Reserve Notes. Until the mid-nineteenth century, commercial banks were able to issue their own banknotes, and notes issued by provincial banking companies were the common form of currency throughout England, outside London. The Bank Charter Act of 1844, which established the modern central bank, restricted authorisation to issue new banknotes to the Bank of England, which would henceforth have sole control of the money supply in 1921.

What types of bonds are there?

The first short-lived attempt at issuing banknotes by a central bank was in 1661 by Stockholms Banco, a predecessor of Sweden’s central bank Sveriges Riksbank. These replaced the copper-plates being used instead as a means of payment. This banknote issue was brought about by the peculiar circumstances of the Swedish coin supply.The interest rate that determines the payment is called the coupon rate. Generally, a central bank or treasury is solely responsible within a state or currency union for the issue of banknotes. However, this is not always the case, and historically the paper currency of countries was often handled entirely by private banks. Thus, many different banks or institutions may have issued banknotes in a given country.

Timeline for Interest and Principal Payments

What is the difference between a bond and a note payable?

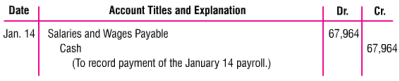

Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current asset or will create a current liability in order to pay the bondholders when the bonds mature. This type of investment is known as a bond sinking fund.

Credit ratings for a company and its bonds are generated by credit rating agencies like Standard and Poor’s, Moody’s, and Fitch Ratings. The very highest quality bonds are called “investment grade” and include debt issued by the U.S. government and very stable companies, like many utilities. Bonds that are not considered investment grade, but are not in default, are called “high yield” or “junk” bonds. These bonds have a higher risk of default in the future and investors demand a higher coupon payment to compensate them for that risk. A senior note is a type of bond that takes precedence over other debts in the event that the company declares bankruptcy and is forced into liquidation.

Bonds Payable Outline

Banknote collecting, or notaphily, is a slowly growing area of numismatics. Although generally not as widespread as coin and stamp collecting, the hobby is slowly expanding.

For years, the mode of collecting banknotes was through a handful of mail order dealers who issued price lists and catalogs. In the early 1990s, it became more common for rare notes to be sold at various coin and currency shows via auction. The illustrated catalogs and “event nature” of the auction practice seemed to fuel a sharp rise in overall awareness of paper money in the numismatic community. The emergence of currency third party grading services (similar to services that grade and “slab”, or encapsulate, coins) also may have increased collector and investor interest in notes. Entire advanced collections are often sold at one time, and to this day single auctions can generate millions in gross sales.Because they carry a lower degree of risk, senior notes pay lower rates of interest than junior bonds. Treasury notes, commonly referred to as T-notes, are financial securities that generally have longer terms than Treasury bills, but shorter terms than Treasury bonds. T-notes are issued by the U.S. government when it aims to generate funds to pay down debts, undertake new projects, or improve infrastructure, for the benefit of the nation and the overall economy. The notes, which are sold in $100 increments, pay interest in six-month intervals and pay investors the full face value of the note, upon maturity.

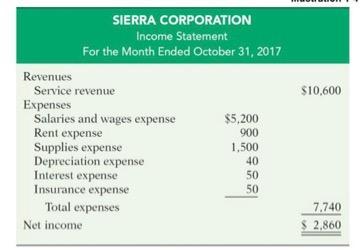

Example of Bonds Payable

- Bonds that are not considered investment grade, but are not in default, are called “high yield” or “junk” bonds.

- Credit ratings for a company and its bonds are generated by credit rating agencies like Standard and Poor’s, Moody’s, and Fitch Ratings.

- The very highest quality bonds are called “investment grade” and include debt issued by the U.S. government and very stable companies, like many utilities.

However, if interest rates begin to decline and similar bonds are now issued with a 4% coupon, the original bond has become more valuable. Investors who want a higher coupon rate will have to pay extra for the bond in order to entice the original owner to sell. The increased price will bring the bond’s total yield down to 4% for new investors because they will have to pay an amount above par value to purchase the bond.At the same time, the Bank of England was restricted to issue new banknotes only if they were 100% backed by gold or up to £14 million in government debt. The Act gave the Bank of England an effective monopoly over the note issue from 1928.Fully printed notes that did not require the name of the payee and the cashier’s signature first appeared in 1855. In medieval Italy and Flanders, because of the insecurity and impracticality of transporting large sums of cash over long distances, money traders started using promissory notes.Today, eBay has surpassed auctions in terms of highest volume of sales of banknotes. However, rare banknotes still sell for much less than comparable rare coins. This disparity is diminishing as paper money prices continue to rise. A few rare and historical banknotes have sold for more than a million dollars.Commercial banks in the United States had legally issued banknotes before there was a national currency; however, these became subject to government authorization from 1863 to 1932. In the last of these series, the issuing bank would stamp its name and promise to pay, along with the signatures of its president and cashier on a preprinted note.

When companies or other entities need to raise money to finance new projects, maintain ongoing operations, or refinance existing debts, they may issue bonds directly to investors. The borrower (issuer) issues a bond that includes the terms of the loan, interest payments that will be made, and the time at which the loaned funds (bond principal) must be paid back (maturity date). The interest payment (the coupon) is part of the return that bondholders earn for loaning their funds to the issuer.

Is Bonds Payable an asset?

Bonds payable are a form of long term debt usually issued by corporations, hospitals, and governments. The issuer of bonds makes a formal promise/agreement to pay interest usually every six months (semiannually) and to pay the principal or maturity amount at a specified date some years in the future.

Bond Interest and Principal Payments

This pivotal shift changed the simple promissory note into an agency for the expansion of the monetary supply itself. As these receipts were increasingly used in the money circulation system, depositors began to ask for multiple receipts to be made out in smaller, fixed denominations for use as money. The receipts soon became a written order to pay the amount to whoever had possession of the note.Cheap foreign imports of copper had forced the Crown to steadily increase the size of the copper coinage to maintain its value relative to silver. The heavy weight of the new coins encouraged merchants to deposit it in exchange for receipts. These became banknotes when the manager of the Bank decoupled the rate of note issue from the bank currency reserves.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Banknotes may also be overprinted to reflect political changes that occur faster than new currency can be printed. The first bank to initiate the permanent issue of banknotes was the Bank of England. Established in 1694 to raise money for the funding of the war against France, the bank began issuing notes in 1695 with the promise to pay the bearer the value of the note on demand. They were initially handwritten to a precise amount and issued on deposit or as a loan. There was a gradual move toward the issuance of fixed denomination notes, and by 1745, standardized printed notes ranging from £20 to £1,000 were being printed.

What are bonds?

Three years later, the bank went bankrupt, after rapidly increasing the artificial money supply through the large-scale printing of paper money. A new bank, the Riksens Ständers Bank was established in 1668, but did not issue banknotes until the 19th century. The shift toward the use of these receipts as a means of payment took place in the mid-17th century, as the price revolution, when relatively rapid gold inflation was causing a re-assessment of how money worked. The goldsmith bankers of London began to give out the receipts as payable to the bearer of the document rather than the original depositor. This meant that the note could be used as currency based on the security of the goldsmith, not the account holder of the goldsmith-banker.