How to Report Taxes of a Municipal Bond Bought at a Premium

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The average annual return over the last ten years was 6.51% as of February 2020. Looking at average annual returns over the last ten years is generally an excellent way to compare the management of high-yield corporate bond funds. Owning high-yield bonds comes with higher default risks unique to this part of the fixed-income market, making diversification via bond funds essential. Investors look to high-yield bonds to earn a better return than low-yielding, but safer, government and investment-grade corporate bonds. While you may not receive a straightforward interest rate with Premium Bonds the NS&I does try to keep the average prizes won in line with the interest rates offered by traditional savings accounts.ETFs avoid many of the expenses and minimums that are typically associated with mutual funds. The fund tracks the performance of the Bloomberg Barclays High Yield Very Liquid Index. The fund had $8.22 billion in AUM and paid a 30-day SEC yield of 4.92% as of February 2020. The fund has a low expense ratio of 0.23%, and it drops to 0.13% for investors who can afford the $50,000 minimum for Admiral Shares. The fund had net assets of $26.8 billion as of January 2020 and a 30-day SEC yield of 3.97% as of February 2020.

Bonds trading at face value, at a discount, or at a premium

That is a lower duration, which indicates the bonds have less exposure to interest rate risk. The fund had a reasonable expense ratio of 0.69% and had an average ten-year return of 7.41%.

How Rising Interest Rates Affect Junk Bonds

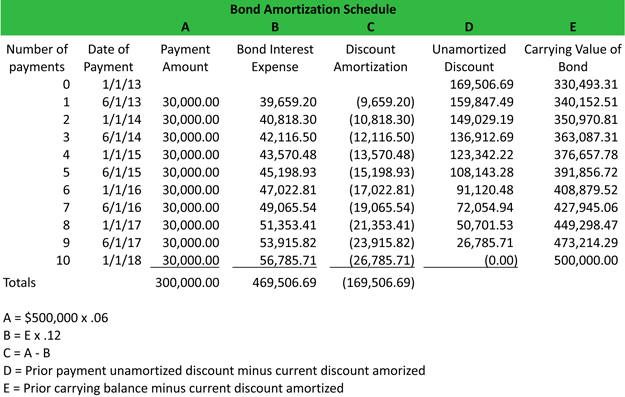

It had net assets of over $18.99 billion and paid a 30-day SEC yield of around 4.57% as of February 2020. It paid a 30-day Securities and Exchange Commission (SEC) yield of 3.58% as of February 2020. The debt securities in the fund’s portfolio had an average weighted maturity of 6.40 years and a duration of 3.32 years.Amortization of debt affects two fundamental risks of bond investing. First, it greatly reduces the credit risk of the loan or bond because the principal of the loan is repaid over time, rather than all at once upon maturity, when the risk of default is the greatest. Second, amortization reduces the duration of the bond, lowering the debt’s sensitivity to interest rate risk, as compared with other non-amortized debt with the same maturity and coupon rate.The BlackRock High Yield Bond Fund, which began trading in 1998, invests in low-rated bonds with maturities of ten years or less. At least 95% of assets are invested in high-yield bonds, which include convertible securities.A bond that is trading above its par value in the secondary market is apremium bond. A bond will trade at a premium when it offers a coupon (interest) rate that is higher than the current prevailing interest rates being offered for new bonds. This is because investors want a higher yield and will pay for it. In a sense they are paying it forward to get the higher coupon payment. You will receive a copy of IRS Form 1099-INT, Interest Income, for each bond you held that paid interest during the year.

What is a bond premium and discount?

A premium bond is a bond trading above its face value or in other words; it costs more than the face amount on the bond. A bond might trade at a premium because its interest rate is higher than current rates in the market.

The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond, and not an established interest rate. For example, a bond with a face amount of $20,000, that matures in 20 years, with a 5.5% yield, may be purchased for roughly $6,757. The difference between $20,000 and $6,757 (or $13,243) represents the interest that compounds automatically until the bond matures. So, the great equalizer is a bond’s yield to maturity (YTM).The YTM calculation takes into account the bond’s current market price, its par value, its coupon interest rate, and its time to maturity.It’s important for investors to know why a bond is trading for a premium—whether it’s because of market interest rates or the underlying company’s credit rating. In other words, if the premium is so high, it might be worth the added yield as compared to the overall market. However, if investors buy a premium bond and market rates rise significantly, they’d be at risk of overpaying for the added premium. Exchange-traded funds (ETFs) that invest in high-yield bonds may be appropriate for investors who are focused on fees.

Other Low-Risk Bonds

- Amortization of debt affects two fundamental risks of bond investing.

- First, it greatly reduces the credit risk of the loan or bond because the principal of the loan is repaid over time, rather than all at once upon maturity, when the risk of default is the greatest.

- Second, amortization reduces the duration of the bond, lowering the debt’s sensitivity to interest rate risk, as compared with other non-amortized debt with the same maturity and coupon rate.

In return, bondholders would be paid 5% per year for their investment. The premium is the price investors are willing to pay for the added yield on the Apple bond.

Bond Premiums and Interest Rates

Also, as rates rise, investors demand a higher yield from the bonds they consider buying. If they expect rates to continue to rise in the future they don’t want a fixed-rate bond at current yields. As a result, the secondary market price of older, lower-yielding bonds fall.These bonds are issued at a deep discount and repay the par value, at maturity. The difference between the purchase price and the par value represents the investor’s return. The payment received by the investor is equal to the principal invested plus the interest earned, compounded semiannually, at a stated yield.As a result, the Apple bond pays a higher interest rate than the 10-year Treasury yield. Also, with the added yield, the bond trades at a premium in the secondary market for a price of $1,100 per bond.

How Does an Investor Make Money On Bonds?

Why would someone buy a bond at a premium?

A bond selling at a premium is one that costs more than its face value, while a discount bond is one selling below face value. Usually, bonds with higher than current interest rates sell a a premium, while those with interest rates below prevailing rates sell at a discount.The Federal Reserve repeatedly reduced interest rates in 2019, leaving many investors searching for higher yields in 2020. High-yield bonds carry more risk than Treasury bonds, yet many investors are being pushed into this market.

There were 514 bonds in the portfolio, with an average effective maturity of 3.0 years and an average duration of 2.0 years as of January 2020. The average annual return for this relatively conservative high-yield fund was 7.10% over the last ten years. The best way for small investors to deal with default risk is through diversification. Fund managers have the resources to buy a wide selection of high-yield corporate bonds, reducing default risk. Investors became increasingly interested in high-yield bonds as long-term Treasury yields fell to record lows during 2019.

Premium Bonds Explained

It also assumes that all coupon payments are reinvested at the same rate as the bond’s current yield. The bond market is efficient and matches the current price of the bond to reflect whether current interest rates are higher or lower than the bond’s coupon rate.This is because as time passes, there are smaller interest payments, so the weighted-average maturity (WAM) of the cash flows associated with the bond is lower. The Vanguard High-Yield Corporate Fund focuses on corporate debt with lower credit ratings. Vanguard states that this approach is intended to return consistent income while minimizing defaults and principal loss. The fund does have higher volatility, closer to that of the stock market. The iShares iBoxx $ High Yield Corporate Bond ETF is another ETF that provides broad exposure to U.S. high-yield corporate bonds.