How to Sell Preferred StockPreferred stockholders enjoy a fixed dividend that, while not absolutely guaranteed, is nonetheless considered essentially an obligation the company must pay. Preferred stockholders must be paid their due dividends before the company can distribute dividends to common stockholders. Preferred stock is sold at a par value and paid a regular dividend that is a percentage of par.

Why do companies redeem preferred stock?

Callable preferred stock is a type of preferred stock in which the issuer has the right to call in or redeem the stock at a pre-set price after a defined date. However, callable preferred share terms laid at the time of issuance cannot be changed later.Nonetheless, there can be a place for preferred shares in a diversified investment portfolio. One way of looking at them is not so much as an alternative to common stock, but as an equity related to a bond. For the risk-averse investor, preferred stocks can be preferable to high-yielding common stocks because payouts are more secure than common share dividends. And unlike common dividends, preferred payouts are predictable — they don’t go up and down with a company’s earnings.

However, unlike bonds that are classified as a debt liability, preferred stock is considered an equity asset. Issuing preferred stock provides a company with a means of obtaining capital without increasing the company’s overall level of outstanding debt. This helps keep the company’s debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level. Preferred stock derives its name from the fact that it carries a higher privilege by almost every measure in relation to a company’s common stock. Preferred stock owners are paid before common stock shareholders in the event of the company’s liquidation.Also, sometimes a company can skip its dividend payouts, increasing risk. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout. Like common stock, preferred stocks represent partial ownership in a company. Preferred stock shareholders may or may not enjoy any of the voting rights of those holding common stock.

Preferred Stocks List

Thus, preferred stocks are generally too expensive a form of capital for strong credits. Therefore, investors should wonder why companies would issue preferred stock paying a generous dividend when they could presumably issue debt securities with more favorable tax consequences. Investors seeking safe returns generally aren’t going to like the answer.

Why do preferred stocks have a face value that is different than market value?

This is attractive to preferred stock holders because they are entitled to the steady stream of dividends, plus they can enjoy appreciation in value if the company’s common stock rises. Preferred stocks are a hybrid of sorts, as they have features of both stocks and bonds.

Benefits of Callable Preferred Stock

Preferred stocks are technically stock investments, standing behind debt holders in the credit lineup. Preferred shareholders receive preference over common stockholders, but in the case of a bankruptcy all debt holders would be paid before preferred shareholders. And unlike with common stock shareholders, who benefit from any growth in the value of a company, the return on preferred stocks is a function of the dividend yield, which can be either fixed or floating. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. (Their preferred status over common stock is the origin of the name “preferred stock.”) Once bondholders receive their payouts, then preferred holders may receive theirs.

What is a Non-Callable Preferred Stock?

When interest rates rise, the value of the preferred stock declines, and vice versa. (A lower credit rating increases the cost.) The answer isn’t reassuring. They may issue preferred stocks because they’ve already loaded their balance sheet with a large amount of debt and risk a downgrade if they piled on more. For example, regulators might limit the amount of debt a company is allowed to have outstanding.

- In fact, preferred stock functions similarly to bonds since with preferred shares, investors are usually guaranteed a fixed dividend in perpetuity.

- So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company.

- A main difference from common stock is that preferred stock comes with no voting rights.

Understanding Safe-Haven Assets

A main difference from common stock is that preferred stock comes with no voting rights. So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company.

Preferred stocks can make an attractive investment for those looking for a higher payout than they’d receive on bonds and dividends from common stocks. But they forgo the safety of bonds and the uncapped upside of common stocks.

What is a non callable preferred stock?

Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock to treasury stock. These terms work well for the issuer of the stock, since the entity can eliminate equity if it becomes too expensive.

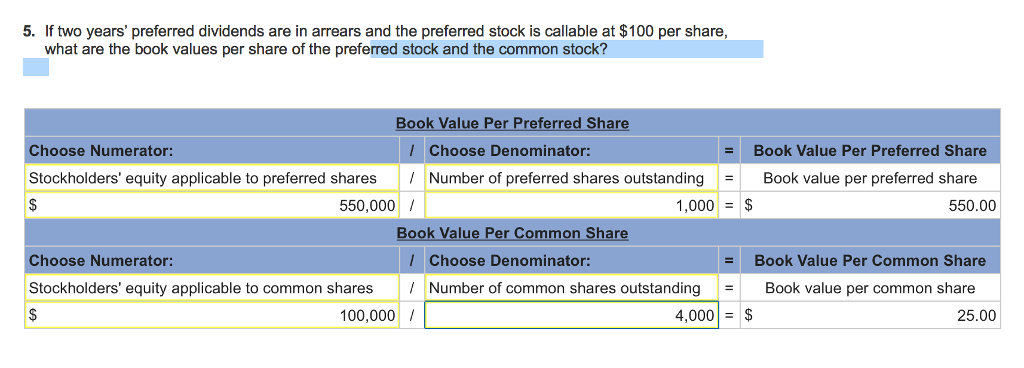

What Dividends in Arrears Means

Since the market is efficient at pricing risk, higher yields must entail greater risk (something investors were likely seeking to avoid in the first place). Investors can benefit from learning to think of things from the company’s perspective. Most companies with solid credit ratings don’t issue preferred stocks (except for regulatory reasons), since the dividend payments are not tax-deductible.Also, unlike common stock, a preferred stock pays a fixed dividend that does not fluctuate. Thus, the company must pay all unpaid preferred dividends accumulated during previous periods before it can pay dividends to common shareholders. If the company is unable to pay this dividend, the preferred shareholders may have the right to force a liquidation of the company. The nature of preferred stock provides another motive for companies to issue it. With its regular fixed dividend, preferred stock resembles bonds with regular interest payments.In fact, preferred stock functions similarly to bonds since with preferred shares, investors are usually guaranteed a fixed dividend in perpetuity. Thedividend yieldof a preferred stock is calculated as the dollar amount of a dividend divided by the price of the stock. This is often based on the par value before a preferred stock is offered. It’s commonly calculated as a percentage of the current market price after it begins trading. This is different from common stock which has variable dividends that are declared by the board of directors and never guaranteed.Preferred stockholders do not typically have the voting rights that common stockholders do, but they may be granted special voting rights. Preferred stocks carry less risk than common stock, but they have more risk than bonds and may not offer a better income from dividends than the interest on bonds. Because of the added risk, investors who own preferred stocks could see larger short-term losses than with bonds. Another important characteristic of preferred shares is that sometimes, but not always, they give their owners the right to convert that preferred stock into common stock at a prearranged price.

Corporate Finance Training

Like bonds, companies must pay on a regular basis a set amount of interest to preferred stock shareholders. The bottom line is that preferred shares’ high yields aren’t sufficient to justify investing in preferred stocks. Overall, investors buying preferred stocks because of the higher yield, possibly combined with the fear of common stock investing, are taking on other risks.In fact, many companies do not pay out dividends to common stock at all. Like bonds, preferred shares also have a par value which is affected by interest rates.