What is a contra asset account?In the double-entry system, transactions are recorded in terms of debits and credits. Since a debit in one account offsets a credit in another, the sum of all debits must equal the sum of all credits. The double-entry system of bookkeeping or accounting makes it easier to prepare accurate financial statements and detect errors.For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount. If a business buys raw material by paying cash, it will lead to an increase in the inventory (asset) while reducing cash capital (another asset).

Changes to YouTube’s Terms of Service

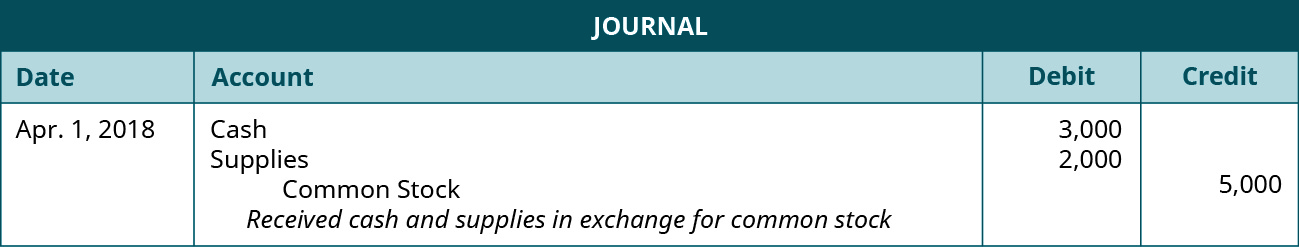

In accounting, a debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger. To be in balance, the total of debits and credits for a transaction must be equal. Debits do not always equate to increases and credits do not always equate to decreases. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced. An example of a compound journal entry is a payroll entry, where there is a debit to salaries expense, another debit to payroll taxes expense, and credits to cash and a variety of deduction accounts.A journal entry is a record of the business transactions in the accounting books of a business. A properly documented journal entry consists of the correct date, amounts to be debited and credited, description of the transaction and a unique reference number. T Accounts are used in accounting to track debits and credits and prepare financial statements. This guide to T Accounts will give you examples of how they work and how to use them. This account appears next to the current asset Accounts Receivable.

What is compound journal entry with example?

A compound journal entry is an accounting entry in which there is more than one debit, more than one credit, or more than one of both debits and credits.

What is a Compound Journal Entry?

To account for the credit purchase, a credit entry of $250,000 will be made to notes payable. The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount.

Example Compound Entry:

Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. A journal details all financial transactions of a business and makes a note of the accounts that are affected. Since most businesses use a double-entry accounting system, every financial transaction impact at least two accounts, while one account is debited, another account is credited.Business transactions are events that have a monetary impact on the financial statements of an organization. When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. The totals of the debits and credits for any transaction must always equal each other so that an accounting transaction is always said to be in balance. Thus, the use of debits and credits in a two column transaction recording format is the most essential of all controls over accounting accuracy.

How do you prepare a single compound journal entry?

Definition: A compound journal entry is one that affects three or more accounts. In other words, it’s an entry that debits or credits at least three accounts in the general ledger. Most business transactions only affect two accounts in the ledger. Take the purchase of inventory for example.So a company might record a $500 loan payment by debiting interest for $50, debiting the liability account for $450, and crediting cash for $500. The three accounts that are affected in this transaction are an asset (cash), liability (the loan account), and equity (expense) account. Journal Entries are the building blocks of accounting, from reporting to auditing journal entries (which consist of Debits and Credits). Without proper journal entries, companies’ financial statements would be inaccurate and a complete mess.

- For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount.

- If a business buys raw material by paying cash, it will lead to an increase in the inventory (asset) while reducing cash capital (another asset).

- Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

The natural balance in a contra asset account is a credit balance, as opposed to the natural debit balance in all other asset accounts. There is no reason for there to ever be a debit balance in a contra asset account; thus, a debit balance probably indicates an incorrect accounting entry. When a contra asset transaction is created, the offset is a charge to the income statement, which reduces profits. Essentially, the representation equates all uses of capital (assets) to all sources of capital (where debt capital leads to liabilities and equity capital leads to shareholders’ equity). For a company keeping accurate accounts, every single business transaction will be represented in at least of its two accounts.Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

contra account definition

In the case of going concerns, there is always a possibility of having balances of assets and liabilities, including capital, which was lying in the previous accounting year. To show a true and fair view of the business concern, it is necessary that all previous balances are to be brought forward in the next year by way of passing an opening entry.Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. The accounting equation shows on a company’s balance sheet whereby the total of all the company’s assets equals the sum of the company’s liabilities and shareholders’ equity. The accounting equation is considered to be the foundation of the double-entry accounting system. The balance sheet is based on the double-entry accounting system where total assets of a company are equal to the total of liabilities and shareholder equity. A journal is a record of transactions listed as they occur that shows the specific accounts affected by the transaction.This means that a journal entry has equal debit and credit amounts. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts.In this system, only a single notation is made of a transaction; it is usually an entry in a check book or cash journal, indicating the receipt or expenditure of cash. A single entry system is only designed to produce an income statement. The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software.

Opening entry, Simple and Compound entries

Used in a double-entry accounting system, journal entries require both a debit and a credit to complete each entry. So, when you buy goods, it increases both the inventory as well as the accounts payable accounts. Opening entries are those entries which record the balances of assets and liabilities, including capital brought forward, from a previous accounting period. In the case of going concerns, there is always a possibility of having balances of assets and liabilities, including capital, which were lying in the previous accounting year.

Definition of Journal

The account Allowance for Doubtful Account is credited when the account Bad Debts Expense is debited under the allowance method. The use of Allowance for Doubtful Accounts allows us to see in Accounts Receivable the total amount that the company has a right to collect from its credit customers. The credit balance in the account Allowance for Doubtful Accounts tells us how much of the debit balance in Accounts Receivable is unlikely to be collected. Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think “debit” when expenses are incurred.

Debit and Credit in Accounting

To show true and fair view of the business concern, it is necessary that all previous balances are to be brought forward in the next year by way of passing an opening entry. To account for the credit purchase, entries must be made in their respective accounting ledgers. Because the business has accumulated more assets, a debit to the asset account for the cost of the purchase ($250,000) will be made.All accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them, and reduced when a credit (right column) is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends.